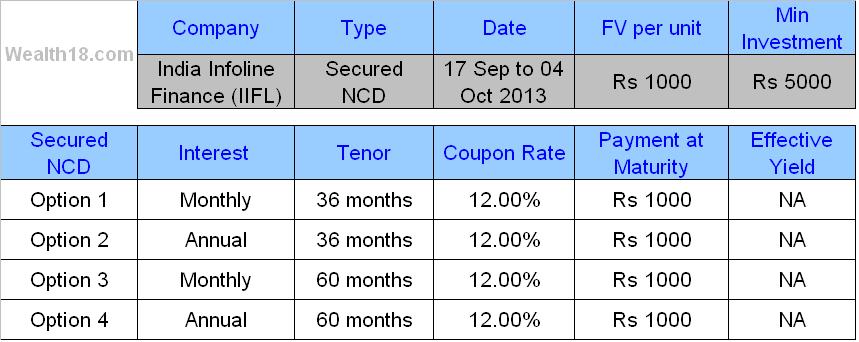

India Infoline is raising Rs 1050 crores through issue of debentures offering 12% for 3 & 5 years tenure.

Issue open & Close : 17th Sep to 4 Oct 2013

Type of Instruments – Secured & UnSecured Redeemable NCDs

Size of Issue – Rs 525 crore through this issue, with an option to retain oversubscription upto Rs 525 crore, aggregating to a total of upto Rs 1050 crore.

Listing – Proposed to be listed on BSE / NSE

Credit Rating – CARE AA by CARE & BWR AA by Brickwork

Investment options – Monthly / Annually / Interest for 3 years & 5 years

About Company

IIFL is a subsidiary of India Infoline Limited (“IIFL”), a diversified financial services company. It is a non-deposit taking NBFC focusing on Mortgage Loans, Commercial Vehicle Finance, Gold Loan, Capital Market Finance and Healthcare Finance.

As on March 31, 2013,

• Mortgage Loans accounted for 41.17% of our Loan Book,

• Capital Market Finance accounted for 13.52% of our Loan Book,

• Health Care Finance accounted for 3.28% and

• Gold Loans accounted for 41.23% of our Loan Book.

• Vehicle Finance is a recent product which has been introduced in FY 2013 and accounted for 0.79% of Loan Book.

The consolidated income from operations and profit after tax (PAT) of the Company for the financial year ending March 31, 2013 stood at Rs 1653 crores and Rs 188 crores respectively.

The company’s consolidated income from operations and PAT witnessed a CAGR of 98.3% and 51.9% respectively over the last three years from FY10 to FY13. The loan book of the company has witnessed a CAGR of 79.3 % over the last three years

Gross / Net NPA for FY 2013 is 0.49 % & 0.17% respectively, which is a good point.

However, company debt equity ratio is around 6 which means company is highly leveraged. Company has debt of around Rs 9000 crore.

Taxation Aspects

- Interest earned on NCD – Taxable as per tax slab of Investor

- If sold on exchange (before 12 months)Short term capital gain / loss – Taxable as per tax slab of Investor

- If sold on exchange (after 12 months) Long term capital gain / loss – Taxable @ 10.30% without indexation

- NCDs taken in the demat form will NOT attract any TDS on the interest income. However, if NCD are taken in physical form, TDS will be applicable if the interest amount exceeds Rs. 5,000

Positive Points

- High Yiled of AA instrument

- If you fall in the lower tax bracket, post-tax returns for some options in this NCD are superior than that of tax-free bonds.

Negative factors

- For an investor in the highest tax bracket, it doesn’t make sense to invest in these as the net returns are comparable with that of the tax-free bonds.

- NCDs are illiquid. If the interest rates fall, it may be difficult for investors to capitalise on falling interest rates. If you invest in govt bonds / short medium term debt funds, and if the interest fall in 2-3 years time frame, they may give you better returns than these NCD offering 12.5%.

How to Apply

- Physical Form – You can download the Form and submit to designated bank branches alongwith cheque – IIFL NCD Application Form Download

- Online – You can invest online in DMAT form through your online share trading account or through your broker.

Summary

- Investors in lower tax slab can consider investing in these NCD, but not more than 10% of their debt allocation.

- Investors in the 30% tax bracket should invest in tax-free bonds or go for debt funds or FMPs