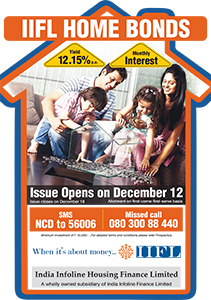

India Infoline Housing Finance Limited (IIHFL), the housing finance arm of India Infoline Limited, plans to open public issue of Secured, Redeemable, Non-Convertible Debentures (NCDs) of face value of Rs 1,000 each. – IIFL Home Bonds

Recently. India Infoline Finance Limited, parent company of IIHFL, raised Rs 1,050 crores,through NCDs.

Issue open & Close : 12 Dec 2013 to 20 Dec 2013

Type of Instruments – Secured Redeemable & non-Convertible Debentures – NCDs

Size of Issue – Rs 250 crore through this issue, with an option to retain oversubscription upto Rs 250 crore, aggregating to a total of upto Rs 500 crore.

Listing – Both DMAT & Phyical Form – Proposed to be listed on BSE / NSE

Credit Rating – CRISIL AA-/Stable’ and ‘CARE AA-‘ (denotes high degree of safety)

Investment options – Monthly Interest for 5 years

Objective – The funds raised through the issue, after meeting the expenditures of and related to the issue, will be used for the financing activities including lending and investments, repaying existing loans and business operations including for capital expenditure and working capital requirements.

IIHFL is wholly owned subsidiary of India Infoline Finance Limited. They received Certificate of Registration (not valid for acceptance of public deposits) from the National Housing Bank (“NHB”) dated February 3, 2009 to carry on the business of a housing finance institution. We offer housing loans and Loans against Property.

Lending products include Mortgage Loans, which includes Retail Mortgage Loans and Corporate Mortgage

Loans.

2012-2013

- Income from operations – Rs 45 crore

- Profir After Tax – Rs 14 crores

- Gross NPA – 0.26% & Net NPA – 0.22%

- Total Debt as on 30-Sep-2013 – 264 crores

Gross Debt: Equity Ratio of the Company:-

Before the issue of debt securities 0.88

After the issue of debt securities 2.53 ( which is one of negative factor)

- The company’s income from operations and PAT witnessed a CAGR of 95.6 % and 92.64 % respectively over the last three years from FY11 to FY13.

- The Loan Book of the company has witnessed a CAGR of 92.37 % over the last three years.

For more details – read Prospectus

Taxation Aspects

- Interest earned on NCD – Taxable as per tax slab of Investor

- No Tax Deducted at Source (TDS) on interest if held in demat account.

- If sold on exchange (before 12 months)Short term capital gain / loss – Taxable as per tax slab of Investor

- If sold on exchange (after 12 months) Long term capital gain / loss – Taxable @ 10.30% without indexation

- NCDs taken in the demat form will NOT attract any TDS on the interest income. However, if NCD are taken in physical form, TDS will be applicable if the interest amount exceeds Rs. 5,000

Positive Points

- High Yiled of AA instrument

- If you fall in the lower tax bracket, post-tax returns for some options in this NCD are superior than that of tax-free bonds.

- Monthly returns

Negative factors

- After this issue, the Debt Equity ratio will be more than 2.5 making it highly leveraged company

- For an investor in the highest tax bracket, it doesn’t make sense to invest in these as the net returns are comparable with that of the tax-free bonds.

- NCDs are illiquid. If the interest rates fall, it may be difficult for investors to capitalise on falling interest rates. If you invest in govt bonds / short medium term debt funds, and if the interest fall in 2-3 years time frame, they may give you better returns than these NCD offering 12.5%.

- Reinvestment Risk – As Interest is paid monthly, you need to find alternative avenue to invest this interest at higher returns so that you have higher cumulative amount.

How to Apply

- Physical Form – You can download the Form and submit to designated bank branches alongwith cheque – IIHFL NCD Application Form Download

- Online – You can invest online in DMAT form through your online share trading account or through your broker.

Summary

- AVOID – as after this issue, the Debt Equity ratio will be more than 2.5 making it highly leveraged company

- Suitable for Investors who can invest lumpsum & need monthly income

- Investors in lower tax slab can consider investing in these NCD, but not more than 10% of their debt allocation.

- Investors in the 30% tax bracket should consider investing in TAX FREE Bonds or go for debt funds or FMPs