From June 2013, when a buyer buys immovable property costing more than Rs 50lakhs, he has to deduct TDS @1% when he pays the seller. Read more details in my other post – TDS on buying/selling of property

- Buyer has to deduct TDS @1% on the entire sale amount (if the property value is more than Rs 50 lakhs)

- This TDS has to be deposited along with Form 26QB within 7 days from the end of the month in which TDS was deducted.

- After depositing TDS to the government, the buyer is required to furnish the TDS certificate to the seller. This is available around 10-15 days after depositing the TDS.

- Thus for paying TDS the seller is required to obtain Form 16B and the buyer is required to obtain Form 26QB.

It is important that you follow the steps properly. Many taxpayers are receiving noticies from Income Tax department for not deducting TDS or not depositing TDS on time or not submitting these forms properly. Read my post – Received notice from the income tax department for non-filing of Form 26QB (TDS on property)

The steps to pay TDS and to obtain Form 16B (for the seller) or Form 26QB (for the buyer) are as follows:

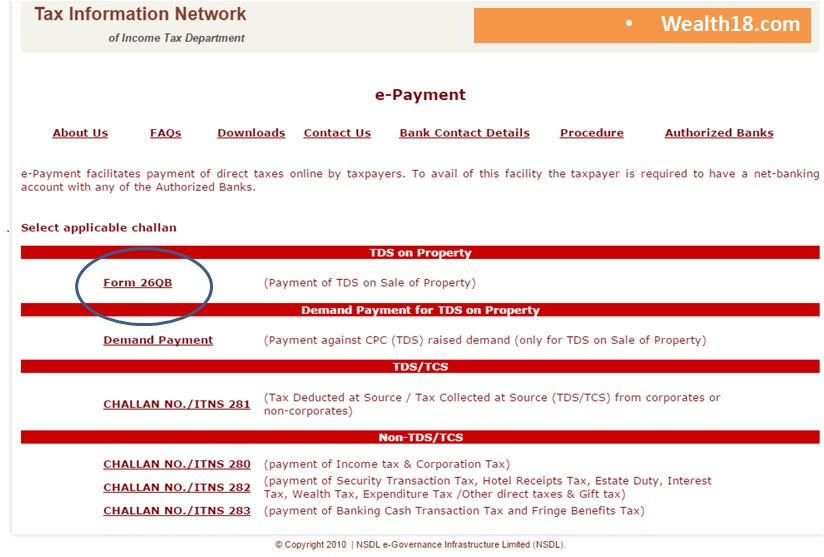

Step 1: Pay the TDS through challan in Form 26QB

a) Go to NSDL TIN website : https://onlineservices.tin.egov-nsdl.com/etaxnew/tdsnontds.jsp

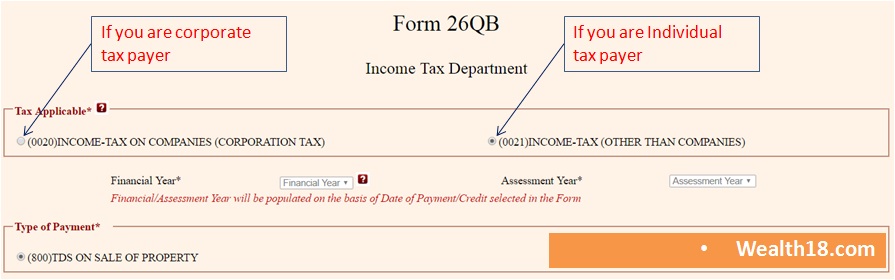

b) Click on Form 26QB and select 0020 if you are corporate payer and 0021 if you are a non-corporate payer. Fill in all the necessary details.

c) Enter details of buyer (Transferee) , seller (Transferor)and property in respective fields.

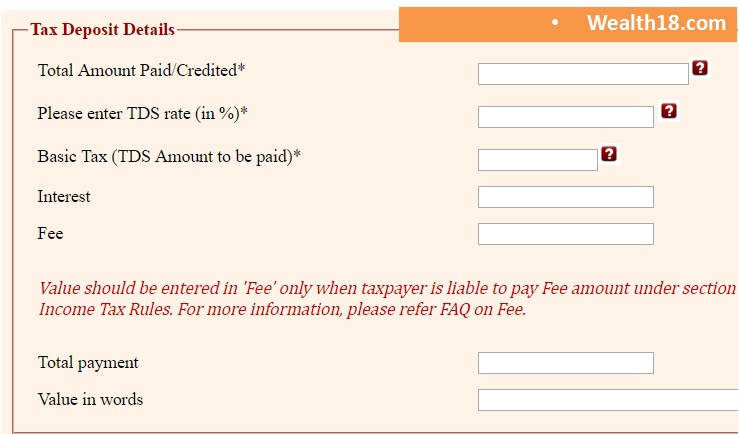

d) Enter amount paid to seller and TDS amount

e) There are 2 modes of payment at the bottom of the page:

- e-tax payment immediately (through net banking facility) and

- e-tax payment on subsequent date (e-payment of taxes by visiting any of the Bank branches).

Choose the one which you prefer and click on Proceed.

e) If you choose net-banking, you will be able to login to your bank and pay online. After you have paid, the bank lets you print Challan 280 with a tick on 800 (i.e. payment of TDS on sale of property). Print this out and keep it safely.

f) If you cannot pay online, an online receipt for Form 26QB with a unique Acknowledgment Number is generated for you. This is valid for 10 days after generation. You can take this to one of the authorized banks along with your cheque. The bank will proceed with the online payment and generate your challan.

Step 2: Generate Form 16B or Form 26QB

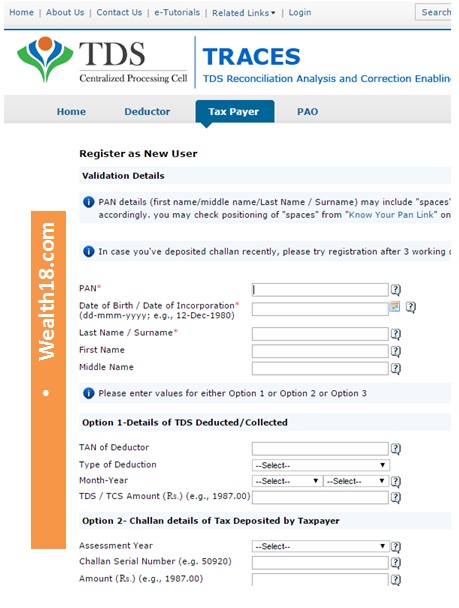

If you are a first-time user, register on TRACES as a Tax Payer with your PAN Card Number and the Challan number registered during payment.

https://www.tdscpc.gov.in/app/tapreg1.xhtml

Enter details as per form above – Enter details in Option 1 or Option 2

Once you register, whether you are a seller or a buyer, you will be able to obtain your approved Form 16B or Form 26QB. Check your Form 26AS seven days after payment. You will see that your payment is reflected in Part F under “Details of Tax Deducted at Source on Sale of Immoveable Property u/s 194(IA) [For Buyer of Property]”.

This gives you details such as TDS certificate number (which TRACES generates), name and PAN of deductee, transaction date and amount, acknowledgment number (which is the same as the one on your Form 26QB), date of deposit and TDS deposited.

Step 3: Download Form 16B or Form 26QB

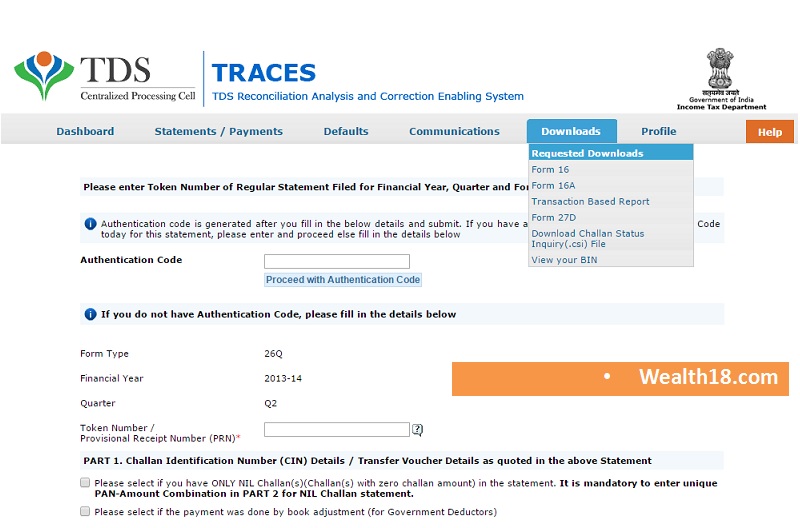

After your payment in Form 26AS has been reflected, login to TRACES. Go to the Download tab at the tab and click on

- Application for Request of Form 16B.

- For Form 26QB click on Application for Request of Form 26QB.

To finish this process, fill in your 9-digit acknowledgment number and the details in Part F of your Form 26AS. This will generate an application request number and give you an application.

After a few hours your request will be processed. Click on the Downloads tab and select Requested Downloads from the dropdown menu.

You should be able to see that the status of your Form 16B or Form 26QB download request is Available. If status says Submitted wait for a few hours more before repeating the last step. Download the .zip file. The password to open the .zip file is Date of Birth of Deductor (the format is DDMMYYYY). Your form will be available inside the .zip file as a pdf.

Now you are able to download Form 26QB & Form 16B.

Many taxpayers are receiving noticies from Income Tax department for not deducting TDS or not depositing TDS on time or not submitting these forms properly. Read my post – Received notice from the income tax department for non-filing of Form 26QB (TDS on property)

If you have any queries related to paying TDS on purchase/sale of property, feel free to ask using comments box below.