Equitas Holdings Ltd is Chennai based financial services provider focused on individuals and micro and small enterprises (MSEs). Equitas offers services to low income groups and economically weaker individuals operating small businesses and MSEs with limited access to formal financing channels.

Equitas is one of the 10 companies that have been selected by the RBI to set up small finance banks (SFB), niche lenders aimed at helping small businesses and farmers get easier access to funding.

Equitas operates in 11 states, one union territory and the NCT of Delhi. As of June 30, 2015, Equitas had 520 branches across India.

The Company has three wholly owned operating subsidiaries. These subsidiaries are engaged in financing activities viz.:

1. Equitas Micro Finance P Ltd – Providing micro loans to people from the EWS/LIG income groups

2. Equitas Finance P Ltd – Used Commercial Vehicle Finance, principally for first time vehicle buyers • Micro Enterprise loans • Mortgage loans for self-employed business people

3. Equitas Housing Finance P Ltd – Micro Housing Finance loans for people typically from EWS/LIG income segments • Affordable Housing Finance loans

Issue Detail:

»» Issue Open: Apr 5, 2016 – Apr 7, 2016

»» Issue Type: 100% Book Built Issue IPO

»» Issue Size: Equity Shares of Rs. 10

»» Issue Size: Rs. 2,175.00 Crore

»» Face Value: Rs. 10 Per Equity Share

»» Issue Price: Rs. 109 – Rs. 110 Per Equity Share

»» Market Lot: 135 Shares

»» Minimum Order Quantity: 135 Shares

»» Listing At: BSE, NSE

Equitas Holdings says IPO aims to raise up to Rs 2,176 crore ($326.97 million) including stake being sold by 13 investors & promoters. Equitas Holdings IPO to include sale of new shares of up to Rs 720 crores.

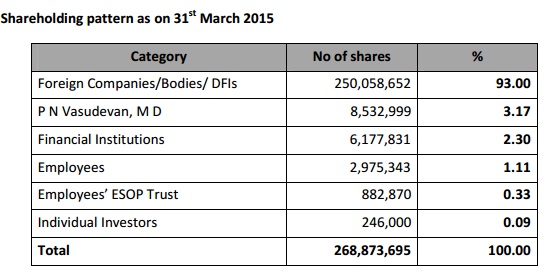

The RBI allows foreign ownership of a maximum 49 percent in small finance banks.The IPO will lower foreign holding in Equitas to about 35 percent from 93 percent currently.

“Out of the total proceeds of the issue, Rs 616 crore will be utilised to invest in our subsidiaries Equitas Finance (EFL), Equitas Micro Finance (EMFL) and Equitas Housing finance (EHFL) and to augment their capital base to meet their future capital requirements,” Vasudevan told reporters here. The company proposes to merge these three subsidiaries into an SFB.

Annual Report for 2014-2015

https://www.equitas.in/sites/default/files/EHL_Annual%20report-Holdings%2014-15_Final.compressed.pdf

Ujjivan Financial Services, another permit winner for small finance bank, has also filed for an IPO.

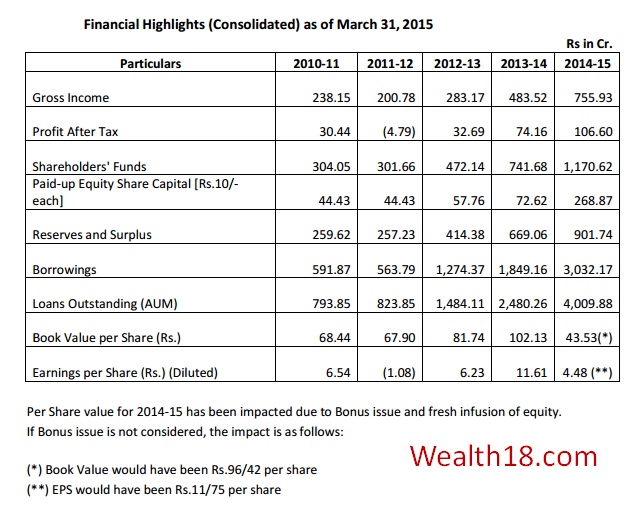

Financials of Equitas Holdings

Shareholding Pattern

Anchor Investors

Ahead of the initial share sale, Equitas Holdings has raised Rs 652 crore from anchor investors by selling shares at a price of Rs 110 apiece. The 15 anchor investors include Franklin Templeton MF, SBI MF, HDFC Standard Life Insurance, Birla Sun Life Trustee, ICICI Prudential MF, Sundaram MF, Tata AIA Life Insurance and Reliance Life Insurance.

Recommendations from Brokerage Houses

| Reliance Securities: | Subscribe (from Long term perspective) |

The brokerage house does not rule out the probability of fluctuation in the return ratios in intermittent period, due to its conversion into SFB. Considering its presence in high growth niche segment, higher margin, superior execution skills demonstrated by the current management team and strong corporate governance track record; Reliance suggests ‘Subscribe’ from a long-term perspective.” |

| SMC Investment and Advisors: | Subscribe (from Long term perspective) |

The expertise of Equitas in lending to unbanked segments is a key strength and this may drive future growth. Moreover, with its experience in vehicle finance and MSE loans, it is expected that the business of the company would also grow in its upcoming Small Finance Bank, for which it has got a license from RBI. Investors with a longer term horizon can opt the issue. |

| Angel Broking: | Subscribe | At the upper band of the offer price (Rs 110) the issue is priced at 1.8x its diluted BV of Rs 60 (pre-dilution 2.3x). The company has decent ROE and ROA of 13 per cent and 3.1 per cent. Though post conversion to a SFB the return ratios might be compressed, while Angel Broking expects the same to scale up subsequently. The brokerage house believes the issue is attractively priced looking at the growth options the company offers in the long run. It recommend ‘Subscribe’ to the issue. |

| Prabhudas Lilladher: | Subscribe | Post issue, at upper band of Rs 110 EHL will trade at 1.9x based on 9MFY16 ABV of Rs 58.6 (including dilution) which the brokerage house believes is fairly priced. Prabhudas Lilladher has ‘Subscribe’ rating on the IPO. |

| Geojit BNP Paribas | Subscribe | Link |

| Aditya Birla Money Equity Research | Subscribe | Link |

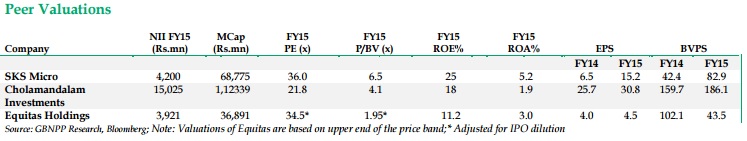

Comparison with SKS MicroFinance

SKS MicroFinance has total revewnue of Rs 803 crore vs Equitas (Rs 756 crores)

SKS Microfinance diluted EPS is 15 as compared with Equitas (4.48)

Therefore, PE ratio for SKS is 35, while PE ratio for Equitas will be 25

Should you invest in Equitas Holdings IPO ?

Reasons to Invest

PE ratio of Equitas will be 25 as compared to its listed peer SKS Microfinace (35) which means the Equitas price is cheap as compared to its peer.

IPO is reasonably priced at 1.85 times the book value (post IPO) at the higher end of the price band. Industry peers such as SKS Microfinance and Sriram Transport finance are trading above 3 times the book.

Reasons not to invest

1) The current foreign investor shareholding in the company is 93% and it will drop down to 35%. Although, RBI requires microfinance companies to have less than 50% foreign shareholding before it issues the bank license, but foreign investors are dropping it to 35%

2) Low Promoter holding of just 3.17% in the company ( P. N Vasudeva)

3) )Increasing future competition as there are about 10 microfinance companies that have been issued small finance bank licenses by the RBI and these will start operations in 2016.

4) For the first nine months, it made consolidated return on asset of 3.1% and return on equity (RoE) of 13%. RoE is lower compared to around 20% for other NBFCs, since it has borrowed three times its equity to fund its business. This is lower than other NBFCs, which have borrowed five-six times their book values.