Update: Check Allotment Status for Rolex Rings IPO

Rolex Rings IPO allotment status is not available at this time. IPO share allotment process takes 6 working days from the issue closing date. Please revisit us to check the latest updates for Rolex Rings IPO allotment status.

Expected allotment status on 5th Aug 2021 on the link below

https://linkintime.co.in/MIPO/Ipoallotment.html

Rolex Rings IPO is oversubscribed 82 times

- QIM oversubscribed: 45.92 times

- NII oversubscribed: 294.19 times

- Retail oversubscribed: 11.74 times

Some of the recently listed IPOs have given 100-300% returns in 2021. Also check the list of upcoming IPOs in 2021.

Rolex Rings IPO is opening on 28th July 2021.

Rolex Rings is one of the top five forging companies in India and a manufacturer and global supplier of hot rolled forged and machined bearing rings, and automotive components for segments of vehicles including two-wheelers, passenger vehicles, commercial vehicles, off-highway vehicles, electric vehicles), industrial machinery, wind turbines, and railways, amongst other segments.

Issue Details of Rolex Rings IPO:

| IPO Opens on | 28 July 2021 |

| IPO Closes on | 30 July 2021 |

| Issue Price band | Rs 960 – Rs 970 |

| Any Discount | NA |

| Issue Size | Rs 700 crore |

| Minimum Investment | 16 shares lot (min amount 14400) |

| Max Investment (Retail) | 13 lots / 208 shares (amount 187200) |

| Registrar | Link Intime |

| Book Running Lead Managers | IDBI Capital, JM Financials, Equirus |

| Listing | BSE/NSE |

| Download | Rolex Rings Red Herring Prospectus |

Rolex Rings IPO Grey market Premium :

- As per market observers, Rolex Rings grey market premium (GMP) was at around ₹440

IPO Issue Allocation:

- QIB = Not More than 50% of the offer

- NII = Not less than 15% of the offer

- Retail = Not less than 35% of the offer

Background:

Incorporated in 2003, Rolex Rings is among the top five forging companies in India. The company manufactures hot rolled forged & machine bearing rings and automotive components that are used across segments i.e. passenger vehicles, 2-wheelers, commercial vehicles, electric vehicles, off-highway vehicles, industrial machinery, wind turbines, railways, etc.

For Fiscal 2020, it supplied bearing rings and automotive components to over 60 customers in 17 countries, primarily located in India, the United States of America, and in European countries such as Germany, France, Italy, and the Czech Republic, and Thailand.

The company is in the process of expanding the capacity of its solar projects by an installed capacity of 12 MW and has already placed purchase orders for equipment with an installed capacity of 7.35 MW.

The company supplies its products to automotive companies and leading bearing manufacturers such as SKF India, Schaeffler India, Timken India etc.

For Fiscal 2021, the company supplied bearing rings and automotive components to over 60 customers in 17 countries, primarily located in India, United States of America and in European countries such as Germany, France, Italy, and Czech Republic, and Thailand.

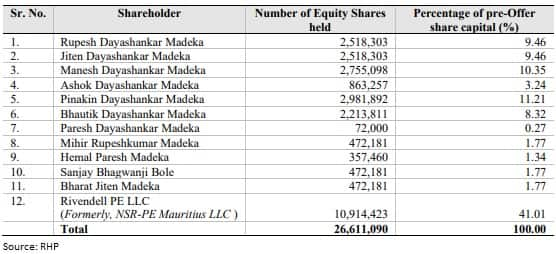

Top Shareholdings:

Rivendell PE LLC (formerly known as NSR-PE Mauritius LLC) held 41.01 percent stake in the company.

Objective of the issue:

Anchor Investors:

The automotive components manufacturer raised ₹219 crore from 26 anchor investors ahead of its IPO. The anchor investors include ITPL – Invesco, Matthews Asia, HSBC Global Investment. In addition, HDFC Trustee Company Ltd, ICICI Prudential, Axis Mutual Fund, Kotak Mahindra Life Insurance and Nippon Life India Trustee were other investors invested in the anchor book bidding

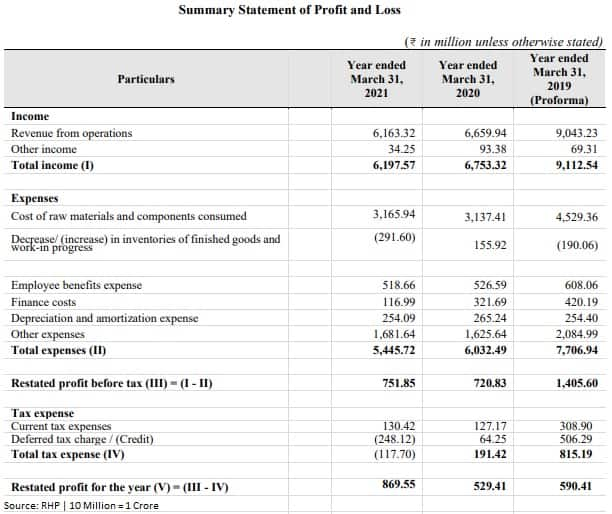

Financials:

| Particulars | For the year/period ended (₹ in million) | ||||

|---|---|---|---|---|---|

| 30-Sep-20 | 31-Mar-20 | 31-Mar-19 | 31-Mar-18 | ||

| Total Assets | 6,710.26 | 6,861.73 | 7,822.57 | 8,034.97 | |

| Total Revenue | 2,254.59 | 6,753.32 | 9,112.54 | 7,915.43 | |

| Profit After Tax | 253.14 | 529.41 | 590.41 | 728.77 | |

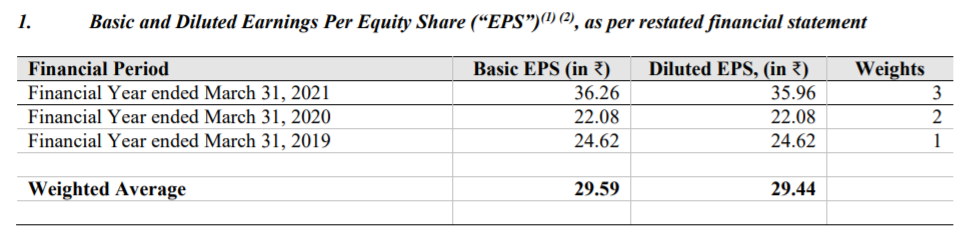

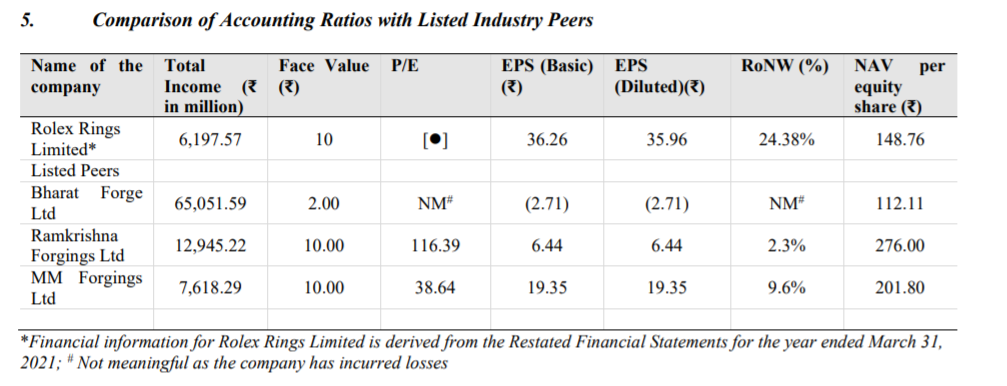

Valuation as compared to its peers:

Based on 2021 EPS, the PE ratio for Rolex Rings is 26.75, which is lower than competitors (Ramkrishna Forgings, MM forgings)

Brokerage Recommendations:

| Brokerage | Recommendations |

| ICICI Direct | Subscribe |

| Reliance Securities | Subscribe |

| Ventura Securities | Subscribe |

| Angel Broking | Subscribe |

| Choice Broking | Subscribe with caution |

| Marwadi Financial | Subscribe with caution |

Important Dates:- IPO Schedule (Tentative)

| Finalization of Basis of Allotment | 4th Aug |

| Initiation of Refunds | 5th Aug |

| Credit of Equity Shares: | 6th Aug |

| Listing Date: | 9th Aug |

Subscription Details: (Will be Updated)

| (Subscription-Category-Wise (no. of times) Till time : 06:00 PM) | Shares Offered | Day-1 | Day-2 | Day-3 |

|---|---|---|---|---|

| QIB | 0 | 2.66 | 45.92 | |

| NII | 0.24 | 6.84 | 294.18 | |

| Retail | 3.57 | 9.27 | 11.74 | |

| Employee | ||||

| TOTAL | 1.84 | 6.86 | 82.03 |

Should you invest:

It is one of the key manufacturers of bearing rings in India and cater to most of the leading bearing companies in India. ‘For Rolex Rings, the revenues for most listed peers and the company have declined over the past four years but the company has generated better ROEs on account of better Asset Turnover. The company has a long-standing relationship with existing clients and the with newer products, it should be able to increase the share from existing customers.

How to apply for Rolex Rings IPO through Zerodha

Zerodha customers can apply online in Rolex Rings IPO using UPI as a payment gateway. Zerodha customers can apply in Rolex Rings IPO by login into Zerodha Console (back office) and submitting an IPO application form.

- Visit the Zerodha website and login to Console.

- Go to Portfolio and click the IPOs link.

- Go to the ‘Rolex Rings IPO’ row and click the ‘Bid’ button.

- Enter your UPI ID, Quantity, and Price.

- ‘Submit’ IPO application form.

- Visit the UPI App (net banking or BHIM) to approve the mandate.

Disclaimer: This article is for educational purposes and should not be treated as investment advice. Please consult with your investment advisor before making any investment decisions.