New India Assurance Company is a 100 % Govt owned multinational general insurance company.

Issue Details of New India Assurance IPO:

- IPO Open: 1st Nov – 2nd Nov 2017

- Issue Price band: Rs 770 – 800

- Issue Size: Rs 9600 crore

- Market lot: 18 shares

- Minimum Investment: 14400 (Rs 800 per share)

- Max Investment for Retail Investor – 234 shares

- Book Running Lead Managers: Axis Capital

- Registrar: Link Intime

- Listing: BSE/NSE

- Download – New India Assurance IPO Red Herring Prospectus

New India Assurance IPO Grey market Premium :

- 22.10.2017 GMP Rs per equity share

IPO Issue Allocation:

- Qualified institutional buyers (QIBs) – 50% of the offer.

- Non-institutional bidders – 15% of the offer.

- Retail individual bidders – 35% of the offer.

Background: New India Assurance Co is the largest general insurance company in India in terms of net worth, domestic gross direct premium, profit after tax and number of branches as of and for the fiscal year ended March 31, 2017. As of March 31, 2017, the company had issued 27.10 million policies across all product segments, the highest among all general insurance companies in India. The company covers insurance products in various product verticals: fire insurance; marine insurance, motor insurance, crop insurance, health insurance and other insurance products.

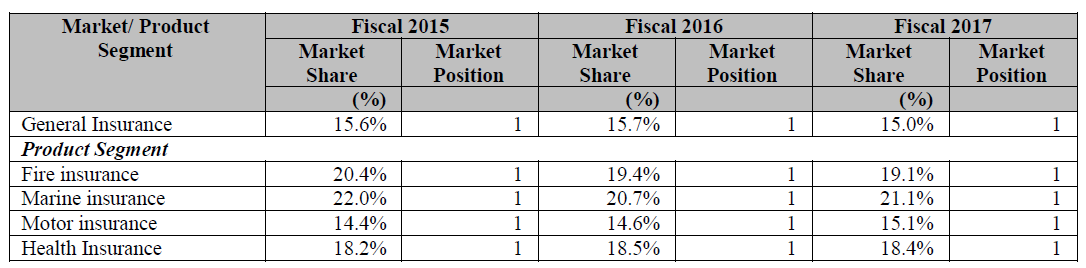

In Fiscal 2017, thegross direct premium from fire, engineering, aviation, liability, marine, motor and health insurance represented a market share of 19.1%, 21.9%, 29.6%, 18.2%, 21.0%, 15.1% and 18.4%, respectively, of total gross direct premium in these segments in India, and the company is market leader in each such product segment

Industry Overview: India is amongst the top 15 general insurance markets in the world and one of the fastest growing markets.

India’s general insurance penetration (i.e., gross insurance premiums as a percentage of GDP) stood at 0.8% in 2016, compared with 0.6% in 2007. In comparison, the global general insurance industry’s penetration stood at 2.81% as of 2016.

Among the comparable Asian counterparts also, India’s general insurance penetration pales; the corresponding numbers for China, Thailand, Singapore and Malaysia were at 1.8%, 1.7%, 1.7%, and 1.6% respectively as of 2016. This suggests the enormous untapped potential of the Indian general insurance market.

The company has increased market share in terms of gross direct premium from 14.7% in Fiscal 2012 to 15.0% in Fiscal 2017 despite of increased competition from private players.

Top Shareholdings: 100% Government Shareholding

Objective of the issue: The proceeds of the Offer for Sale shall be received by the Selling Shareholder. Our Company will not receive any proceeds from the Offer for Sale.

Anchor Investors: One day before the issue.

Financials:

| in crores | Gross Premium | Total Net Worth | Solvency Ratio | Income | Operating profit | Revenue | PAT |

| 2017 | 23030 | 36298 | 2.22 | 20471 | -877 | 942 | 819 |

| 2016 | 19227 | 17585 | -486 | 1062 | 934 | ||

| 2015 | 16987 | 15632 | 97 | 1704 | 1374 | ||

| 2014 | 12846 | -358 | 905 | 797 | |||

| 2013 | 25470 | 11220 | -67 | 1005 | 883 | ||

EPS for the last 3 years is 10.72 (2017), 12.02 (2016) and 17.70 (2015). Its weighted average EPS is 12.32

At the issue price of Rs 800 , the PE ratio of 65 seems too high.

Valuation as compared to its peers:

ICICI Lombard had the PE ratio of 46 times based on FY2017 (at price band of Rs 661)

| Similar Companies | CMP | Market Cap | PE Ratio |

Brokerage Recommendations:

| Subscribe | |

Should you invest: Although the company is the market leader in the general insurance, the valuation seems quite high.

I will personally avoid this IPO primarily because of high valuation.