SBI Cards IPO to open on March 2, 2020

The long-awaited initial public offering of SBI Cards and Payment Services, a subsidiary of the country’s largest lender State Bank of India, is set to open for subscription. It will be the largest IPO after GIC IPO in 2017.

State Bank of India owns 74% stake in the company and the rest 26% is held by CA Rover Holdings, an affiliate of the Carlyle Group.

Issue Details of SBI Cards IPO:

| IPO Opens on | 2 March 2020 |

| IPO Closes on | 5 March 2020 |

| Issue Price band | Rs 750 – Rs 755 |

| Any Discount | NA |

| Issue Size | Rs 10,354 crore |

| Minimum Investment | 19 shares |

| Registrar | Link Intime |

| Book Running Lead Managers | Axis, BoA, HSBC, Nomura, SBI Cap |

| Listing | BSE/NSE |

| Download | SBI Cards Red Herring Prospectus |

SBI Cards IPO Grey market Premium :

- 28 Feb 2020 – GMP Rs 200-250 per equity share

IPO Issue Allocation:

- Investors Portion: QIB = Not More than 50% of the offer, NII = Not less than 15% of the offer and Retail = Not less than 35% of the offer

- Employee Reservation Portion: Up to 1,864,669 Equity Shares

- Shareholders Reservation Portion: Up to 13,052,680 Equity Shares

SBI Shareholders Reservation in SBI Cards IPO

Investors who hold SBI shares on the 18th Feb 2020 (the date of filing RHP with SEBI) are eligible to apply under the shareholder’s category of SBI Cards IPO. As per RHP, the SBI shareholders can apply above Rs 2 lakh and maximum up to reserved poprtion for the SH category. SBI shareholders (bidding up to ₹2 lakhs) can also apply under the retail category. Further, if an SBI shareholder is also an SBI employee, he/she is also eligible to apply in all the three categories- RII (up to ₹2 lakhs), Shareholder (up to ₹2 lakhs) and Employees (up to ₹5 lakhs).

SBI Employees Reservation in SBI Cards IPO

Full-time or permanent employees of SBI (as on RHP filing date) can apply in the SBI Employees category of SBI Cards IPO. The maximum limit defined to apply in the Employee category is ₹5 lakhs. The maximum allotment to employees cannot be above ₹2 lakhs when the category is fully or oversubscribed. In case of under-subscription in the employee category, the unsubscribed portion will be available for allocation, proportionately to all Eligible Employees who Bid above ₹2 lakhs, subject to maximum limit not exceeding ₹5 lakhs.

Background:

SBI Cards and Payment Services Limited is a subsidiary of SBI. The company the 2nd largest credit card issuer in the country, with approx 18% market share of the Indian credit card market (number of credit cards & spends) as of November 30, 2019.

SBI Cards has partnered with several leading names across industries, including Air India, Apollo Hospitals, BPCL, Etihad Guest, Fbb, IRCTC, OLA Money and Yatra, amongst others.

Top Shareholdings:

SBI Cards is 74% owned by SBI while Carlyle Group owns the remaining 26%. Carlyle bought the stake in 2017 from GE.

As part of the IPO, SBI will divest 4% of its stake, while Carlyle will sell 10% of its stake.

Objective of the issue:

The objective of the offer for sale is to allow the selling shareholders (State Bank of India and CA Rover) to sell equity shares held by them. Hence, SBI Cards will not receive any proceeds from the offer for sale.

The net proceeds of the fresh issue are proposed to be utilised for augmenting the capital base of the company to meet future capital requirements.

Anchor Investors: To be updated

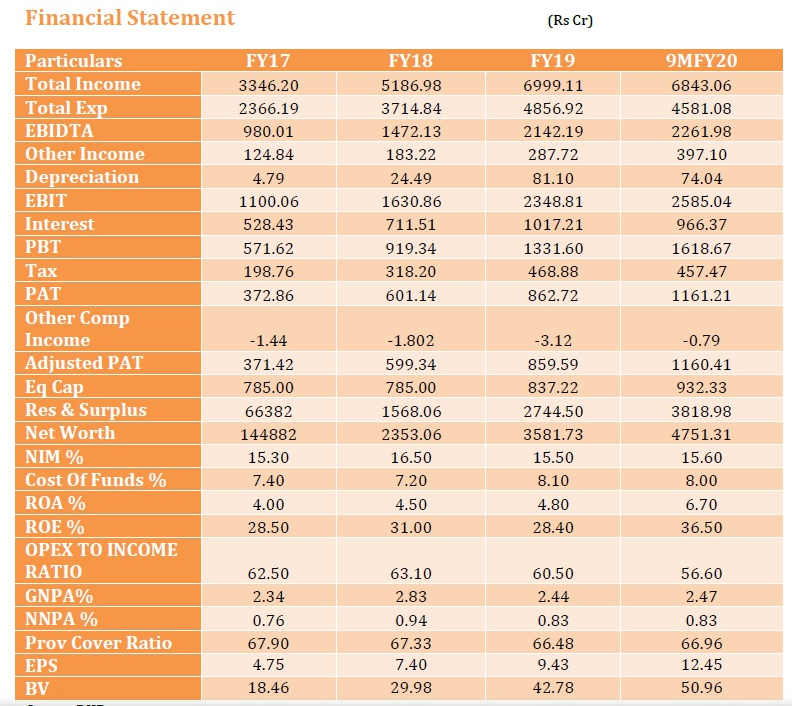

Financials:

The company’s total income increased at a CAGR of 44.9% and the revenues from operations have increased at a CAGR of 44.6% between fiscal 2017 to 2019. The net profit grew at a CAGR of 52.1% during the period.

SBI Cards commands a relatively strong return on assets of 5.5 %, driven by better fees and low credit costs. The industry average for the cards business stands at 3.5 %. SBI Cards has not seen its return on equity (RoE) dip below 25% in the past 6-7 years and has averaged around 30 per cent RoE during that time.

| Particulars | December 31, 2019 | March 31, 2019 | March 31, 2018 | March 31, 2017 | CAGR (%) (FY17-19) |

| Total Income | 7240 | 7287 | 5370 | 3471 | 45% |

| Profit for the period/year | 1161 | 863 | 601 | 373 | 52% |

Valuation as compared to its peers:

It is the first credit card company to be listed separately.

Brokerage Recommendations:

| Brokerage | Recommendations |

| Yes Securities | Subscribe |

| Samco Sec | Subscribe |

| Motilal | Subscribe |

Important Dates:- IPO Schedule (Tentative)

| Finalization of Basis of Allotment | |

| Initiation of Refunds | |

| Credit of Equity Shares: | |

| Listing Date: | around 16th March 2020 |

Subscription Details: (Will be Updated)

| (Subscription-Category-Wise (no. of times) Till time : 06:00 PM) | Shares Offered | Day-1 | Day-2 | Day-3 |

|---|---|---|---|---|

| QIB | ||||

| NII | ||||

| Retail | ||||

| Employee | ||||

| TOTAL |

Should you invest:

It is the first credit card company to get listed. The CAGR in Revenue and profits over last few years have been excellent. It is the most profitable vertical of SBI.

Most likely the issue will give good listing gains due to huge demand as well as very profitable business. Investors should consider investing in this IPO.

Disclaimer: This article is for educational purposes and should not be treated as investment advice. Please consult with your investment advisor before making any investment decisions.