RBL Bank (formerly called Ratnakar Bank) will open its initial public offer (IPO) on August 19, at a price band of Rs 224-225 per share. The company is planning to raise over Rs 1,200 crore. This is the first Indian bank IPO in last 6 years.

Issue Details

- Issue Dates : Aug 19 to Aug 23 2016

- Price Band: Rs 224 – 225 per share

- Bid lot: 65 equity shares or multiples thereof

- Overall issue size: 5.4 crore shares

- Face Value – Rs 10

- Book Managers – Kotak Mahindra Capital, Axis Capital, CitiGroup, Morgan Stanley India, HDFC Bank, ICICI Sec, IDFC Sec, IIFL, SBI Cap

Grey Market price: In the grey market, the RBL IPO is trading at approx Rs 50 premium now (GMP) . So there is a potential listing gain for that amount. Please note this is just an estimate price.

Background

RBL Bank Ltd is a Mumbai based private sector bank offering range of banking products and services to large corporations, SMEs, agricultural customers, retail customers and development banking & financial inclusion (low income) customers. It was incorporated in 1943 as a regional bank in Maharashtra.

As of March 31, 2016, RBL had 197 branches and 362 ATMs spread across 13 Indian states serving over 1.3 million customers.

RBL acquired certain Indian businesses of the Royal Bank of Scotland (RBS), including the RBS business banking, credit card and mortgage portfolio businesses, in 2014. RBL business segments consist of corporate and institutional banking, commercial banking, branch and business banking, agribusiness banking, development banking and financial inclusion and treasury and financial markets operations

Shareholding Pattern

| No. | Shares | % | |

| FII | 1 | 970000 | 0.33 |

| Bodies Corporate | 89 | 69501204 | 23.62 |

| NRI | 23 | 5570150 | 1.89 |

| Trust | 1 | 4282195 | 1.46 |

| Individuals | 11595 | 99045649 | 33.66 |

| Foreign Bodies | 14 | 114848652 | 39.03 |

| Others | 1 | 5000 | 0.01 |

| 11724 | 294222850 | 100 | |

| Wealth18.com |

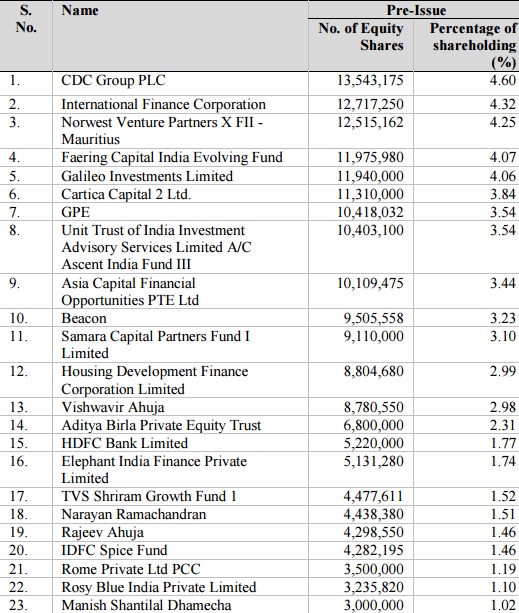

Public Shareholding for more than 1%

Objective of the Issue

The issue comprises fresh issue of equity shares by the bank aggregating up to Rs 832.5 crore and an offer for sale up to 1,69,09,628 equity shares.

- Offer for Sale: RBL Bank will not receive any proceeds from the Offer for Sale.

- Fresh Issue: Augment capital base to meet Banks future capital requirements , Enhance visibility & brand name, General Corporate Purposes

In Dec 2015, the bank has made a pre-IPO placement for Rs 488 crore (2.5 crore equity shares at a price of Rs 195 per share). Investors include CDC Group, DVI Fund (Mauritius), Rimco (Mauritius), Asian Development Bank and CDC Group PLC and DVI Fund (Mauritius).

IPO issue allocation

- QIB – 50% (upto 60% to Anchor investor, 33% for domestic MF only)

- HNI – 15%

- Retail – 35%

Financials

The bank earned a net profit of Rs. 292.48 crore on revenues of Rs. 3,234.85 crore for the financial year 2015-16, up from Rs. 208.45 crore and Rs. 2,356.5 crore in the preceding financial year.

The diluted EPS was Rs.9.43 for 2015-16 as against Rs. 7 in 2014-15 (Diluted earnings per share reflect the potential dilution that could occur if contracts to issue equity shares were exercised or converted during the period).

Deposits and advances stood at Rs. 24,348 crore and Rs. 21,229 crore, respectively, as of March 31, 2016.

Net non-performing assets (NPAs) as percentage of total advances rose to 0.59 percent from 0.27 percent at the end of financial year 2014-15.

During 2011-15,

- total income has grown substantially from Rs 208 crores to Rs 2356 crores which represents a compound annual growth rate (CAGR) of 83.52% for the past four fiscal years.

- net profit after tax has increased from Rs 5.6 crore 207 crores which represents a CAGR of 146.75% for the past four fiscal years.

The income from commission, exchange and brokerage, profit on exchange transactions (net) and miscellaneous income constituted 25.38%, 36.03% and 35.50% of net total income (defined as the sum of interest income and other income less interest expense) in the fiscal years ended March 31, 2013, March 31, 2014 and March 31, 2015, respectively

As of March 31, 2015, 41.37% of the paid-up share capital was held by non-residents

Anchor investors : To be update one day before the issue open

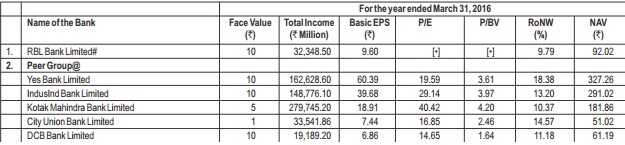

Valuation as compared to its peers

At Rs 225 price, the PE ratio comes to 23.43 which is higher than Yes Bank and lower than IndusInd & Kotak.

Should you invest : Subscribe

| Antique Broking | Subscribe |

| Angel Broking | Subscribe |

| Anand Rathi | Subscribe |