Metropolis Healthcare Limited (MHL) is a Mumbai based leading diagnostic companies that is coming up with its IPO to raise around Rs. 1,200 crore.

Issue Details of RVNL IPO:

| IPO Opens on | 3 April 2019 |

| IPO Closes on | 5 April 2019 |

| Issue Price band | Rs 877 – Rs 880 |

| Any Discount | NA |

| Issue Size | Rs 1200 crore |

| Minimum Investment | 17 shares (Rs 14960) |

| Registrar | Link Intime |

| Book Running Lead Managers | Credit Suisse and Goldman Sachs |

| Listing | BSE/NSE |

| Download | Metropolis Healthcare Red Herring Prospectus |

Metropolis Healthcare IPO Grey market Premium :

- 30 March 2019 – GMP Rs 45 per equity share

IPO Issue Allocation:

- Qualified institutional buyers (QIBs) – 50% of the offer.

- Non-institutional bidders – 15% of the offer.

- Retail individual bidders – 35% of the offer.

Background:

They are one of the leading diagnostics companies in India, by revenue, as of March 31, 2018 (Source: Frost & Sullivan). They have widespread presence across 18 states in India, as of March 31, 2018, with leadership position in west and south India (Source: Frost & Sullivan).

Through their widespread operational network, they offer a comprehensive range of clinical laboratory tests and profiles, which are used for prediction, early detection, diagnostic screening, confirmation and/or monitoring of the disease. They also offer analytical and support services to clinical research organizations for their clinical research projects.

During the financial year 2018, they conducted approximately 1.6 crore tests from approx 77 lakhs patient visits. They offer a broad range of approximately 3,480 clinical laboratory tests and 524 profiles, as of March 31, 2018. The profile comprises of a variety of test combinations which are specific to a disease or disorder as well as wellness profiles that are used for health and fitness screening

The company derives 62.75% of its revenues from 5 focus cities which are amongst the top 8 GDP cities in India. All these cities (Mumbai, Bengaluru, Chennai, Surat and Pune) are in the southern and western part of India. MHL operates a ‘hub and spoke’ model for quick and efficient delivery of services through their laboratory and service network, which covered 197 cities in India, as of December 31, 2018

Industry Overview

From the financial year 2015 to the financial year 2018, the Indian diagnostic industry is estimated to grow at a CAGR of approximately 16.5% to approximately ₹ 596 billion (USD 9.1 billion) in the financial year 2018. For the next two years, India’s diagnostic industry is expected to grow at a CAGR of approximately 16% to reach approximately ₹ 802 billion (USD 12.3 billion) in the financial year 2020. Within the diagnostics market, the pathology segment is estimated to contribute approximately 58% of total market, by revenue, in the financial year 2018, while the remaining 42% is estimated to be contributed by the radiology segment.

Diagnostics industry remains highly fragmented – Standalone centers dominate the diagnostic market with a 47% share, while hospital-based laboratories have a 37%

market share. Diagnostic chains have a 16% market share and are further split into pan-India chains and regional chains. There are very few pan-India chains, which together have a share of approximately 35 to 40% of the organized diagnostic market. Regional chains constitute the rest of the market.

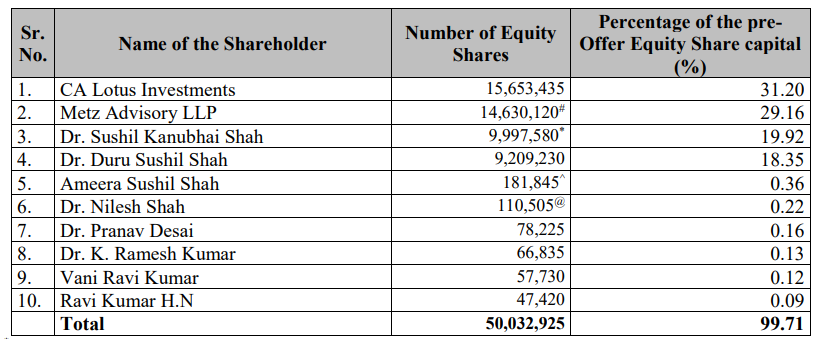

Top Shareholdings:

Objective of the issue:

The company will not receive any proceeds from the Offer and all the proceeds will be received by the Selling Shareholders, in proportion to the Offered Shares sold by the respective Selling Shareholders as part of the Offer.

- To achieve the benefits of listing the Equity Shares on the Stock Exchanges and for the Offer for Sale.

- Further, the Company expects that listing of the Equity Shares will enhance its visibility and brand image and provide liquidity to our Shareholders. The listing will also provide a public market for the Equity Shares in India.

Anchor Investors: To be updated

Financials:

The consolidated revenue of the company has increased at a CAGR of 16.3 % during FY16-18. The net profit for MHL increased at a CAGR of 15.7 % in the same period.

| Particulars | December 31, 2018 (9 months) | March 31, 2018 | March 31, 2017 | March 31, 2016 (Proforma) | CAGR (%) (FY16-18) |

| Total Income | 566.82 | 651.555 | 567.659 | 490.634 | 15.20% |

| Total Expense | 431.155 | 491.254 | 410.391 | 366.422 | 15.80% |

| Profit for the period/year | 88.771 | 109.747 | 107.257 | 81.955 | 15.70% |

| Basic earnings per share (Rs.) | 17.18 | 20.61 | 20.48 | 15.25 | 16.30% |

| Diluted earnings per share (Rs.) | 17.15 | 20.49 | 20.35 | 15.14 | 16.30% |

Valuation as compared to its peers:

The issue is asking for a market cap to sales (FY18) of 6.78 times, which is lower as compared to its listed peer – Dr Lal Pathlabs- that is trading at a market cap to sales (FY18) of 8.57 times.

In terms of price to earnings (PE) ratio also company’s issue is being offered as a lower price. Dr Lal Pathlabs is trading at a current PE of 51.34 times compared to MHL offer at a PE of 43x.

| Key Parameters | Dr. Lal Path Labs | Metropolis |

| Clinical Laboratory | 191 | 115 |

| Patient Service Center | 2153 | 256(owned)+1375(Third Party) |

| Pick Up points | 5624 | 9000 |

| Number of Patient Visit per Year | 15 Million | 7 Million |

| Presence | Mainly in North India | Mainly in west and south India. |

| Employees | 4316 | 4113 |

| Revenue(FY-18) | 1088 Cr | 651 Cr |

| Revenue Growth in 3 Years(FY16 to FY18) | 15.70% | 15.24% |

| PAT(FY-18) | 172 Cr | 110 Cr |

| PAT Growth in 3 Years( FY16 to FY-18) | 15.59% | 17.53% |

| EPS(FY-18) | 20.82 | 20.61 |

| P/E( after annualizing 9MFY19 Financials) | 43 | 37 |

| Mcap | 8782 Cr | 4431 Cr |

| ROE | 21.66% | 25.75% |

| ROCE | 33% | 37% |

Brokerage Recommendations:

| Brokerage | Recommendations |

Important Dates:- IPO Schedule (Tentative)

| Finalization of Basis of Allotment | on or Before 10 April 2019 |

| Initiation of Refunds | on or Before 12 April 2019 |

| Credit of Equity Shares: | on or Before 15 April 2019 |

| Listing Date: | on or Before 16 April 2019 |

Subscription Details: (Will be Updated)

| (Subscription-Category-Wise (no. of times) Till time : 06:00 PM) | Shares Offered | Day-1 | Day-2 | Day-3 |

|---|---|---|---|---|

| QIB | ||||

| NII | ||||

| Retail | ||||

| Employee | ||||

| TOTAL |

Should you invest:

The company has shown good revenue and profit growth in the last 5 years. It has a debt free status, which is positive.

You can consider investing for long term. As the issue price is reasonable as compared to its listed peer, they may be 5-10% listing gains.

Disclaimer: This article is for educational purposes and should not be treated as investment advice. Please consult with your investment advisor before making any investment decisions.