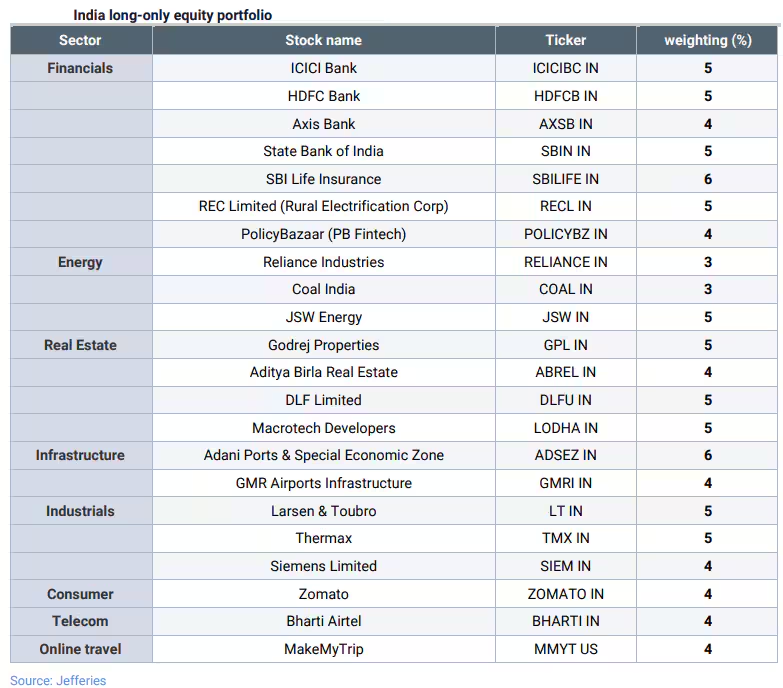

Jefferies’ India long-only equity portfolio comprises 22 stocks from financials, energy, real estate, infrastructure, industrials, consumer, telecom and online travel sectors.

Data shared by Jefferies showed that the long-only portfolio for India, which launched on July 1 2021, rose by 14.2% in US dollar terms last quarter on a total-return basis, compared with a 12% gain in the MSCI India benchmark. It also rose by 44.4% last year compared with a 21.3% gain in the benchmark. As a result, the portfolio is now outperforming since inception, rising by 50.9% as at the end of 2023 compared with a 26.8% increase in the MSCI India Index and a 27.8 per cent gain in the Nifty.