The Indian stock market has seen a significant correction since October 2024, with Nifty corrected 16% from its high and oher indices fell 21% (Midcap 50) and 25% (Small Cap 50). The pain is much deeper in individual stocks which has fallen 50% from its high.

Reason 1: Persistent selling by FII

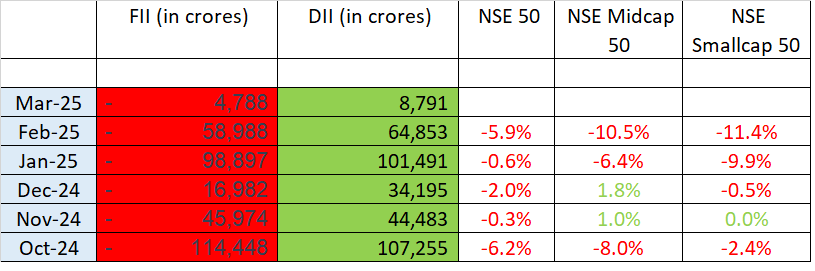

Indian equities have faced heavy selling by FIIs, with outflows exceeding ₹3.4 lakh crore in the in last 5 months. This trend began in late 2024, driven by global trade tensions, rising U.S. bond yields, and a stronger dollar. Additionally, investors shifted funds from India to other emerging markets like China, further pressuring Indian market

Reason 2: High valuations and Earning Slowdown

The Indian market was trading at high valuations, making it vulnerable to corrections. At the same time, corporate earnings growth has slowed due to weaker GDP growth (projected at 6.3% for FY25), fiscal drag, and sluggish credit expansion. Disappointing Q2 FY25 earnings reports further dampened investor sentiment

IPO Market Euphoria – There were 90 mainboard IPOs and 178 SME IPOs on NSE with companies raising Rs 1.6 lakh crore. This marks the highest number of IPOs recorded in any calendar year,

Reason 3: Global uncertainities particularly Tarriffs under Trump regime

The sharp rise in U.S. interest rates has posed a significant threat to emerging markets.

The Indian rupee fell to a lifetime low amid fears of global economic instability caused by the tariffs. A stronger U.S. dollar, driven by rising demand due to tariff-related trade adjustments, has made emerging market currencies like the rupee less attractive.

The imposition of 25% tariffs on steel and aluminum imports from Canada and Mexico, along with 10% additional tariffs on Chinese goods, has heightened global trade tensions. This has led to a risk-off sentiment in global markets, including India, as investors fear escalating trade wars.

Trump’s tariffs have contributed to a spike in oil prices due to increased geopolitical uncertainty and supply chain disruptions

What to do now:

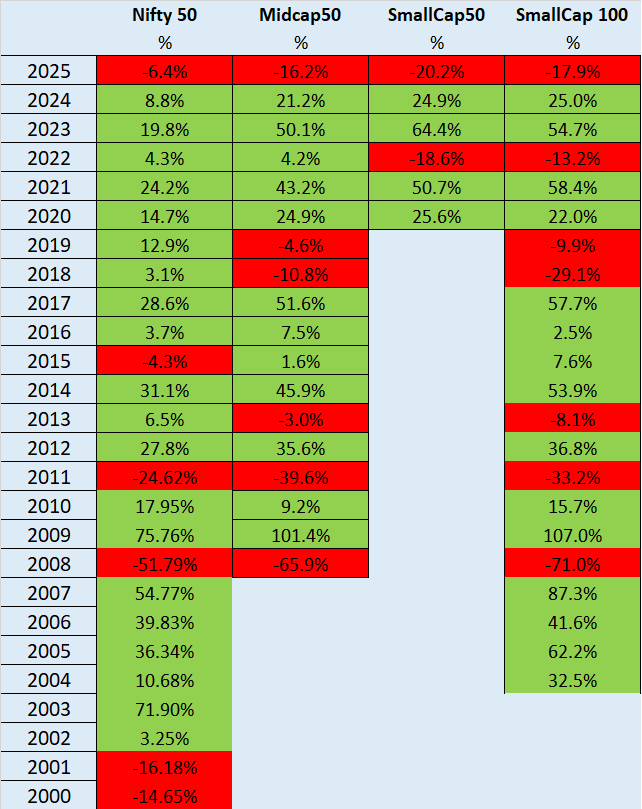

No one can predict how low the market will correct. But the historical data shows that makets are in upward trend in long term. These corrections like market sentiment, 2008 financial crash, Covid etc gives good opportunity for long term investment.

See annual returns over long term

Disclaimer – Please consult your financial advisor before making any investment decisions.