Update: Check Allotment Status for Glenmark Life Sciences IPO

Glenmark Life Sciences IPO allotment status is now available. The allotment status is available at the link below, just select the IPO and enter your PAN. Good Luck!

https://kosmic.kfintech.com/ipostatus/

Glenmark Life Sciences IPO is oversubscribed 28.67 times

- QIM oversubscribed: 13.31 times

- NII oversubscribed: 99.24 times

- Retail oversubscribed: 7.07 times

Glenmark Life Sciences IPO is opening on 27th July 2021.

Glenmark Life Sciences is a leading developer and manufacturer of select high value, non-commoditized active pharmaceutical ingredients (APIs) in chronic therapeutic areas, including cardiovascular disease (CVS), central nervous system disease (CNS), pain management and diabetes, as per Frost & Sullivan report. It also manufactures and sells APIs for gastro-intestinal disorders, anti-infectives and other therapeutic areas.

In 2019, the API manufacturing business of Glenmark Pharma was sold and spun off into Glenmark Life as part of a broader reorganization designed to place Glenmark Pharma on an accelerated trajectory to attain its objectives in three different verticals, with Glenmark Life focusing on the API business. Following the spin-off, the company operates as an independent, professionally-managed global API business.

Issue Details of Glenmark Life Sciences IPO:

| IPO Opens on | 27 July 2021 |

| IPO Closes on | 29 July 2021 |

| Issue Price band | Rs 695 – Rs 720 |

| Any Discount | NA |

| Issue Size | Rs 1513 crore |

| Minimum Investment | 20 shares (Rs 14400) |

| Max Investment (Retail) | 13 lots (Rs 1,87,200) |

| Registrar | KFin Technologies |

| Book Running Lead Managers | Kotak, BofA |

| Listing | BSE/NSE |

| Download | Glenmark Lifesciences Red Herring Prospectus |

Glenmark Life Sciences IPO Grey market Premium :

- 200-300 premium

IPO Issue Allocation:

- QIB = Not More than 50% of the offer

- NII = Not less than 15% of the offer

- Retail = Not less than 35% of the offer

Background:

The company has strong market share in select specialized APIs such as Telmisartan (anti-hypertensive), Atovaquone (anti-parasitic), Perindopril (antihypertensive), Teneligliptin (diabetes), Zonisamide (CNS) and Adapalene (dermatology). The company also increasingly provides contract development and manufacturing operations (CDMO) services to a range of multinational and specialty pharmaceutical companies.

As of March 2021, Glenmark Life had a portfolio of 120 molecules globally and sold APIs in India and exported APIs to multiple countries in Europe, North America, Latin America, Japan and the rest of the world (ROW). As of May 31, 2021, it had filed 403 Drug Master Files (DMFs) and Certificates of suitability to the monographs of the European Pharmacopoeia (CEPs) across various major markets (i.e. United States, Europe, Japan, Russia, Brazil, South Korea, Taiwan, Canada, China and Australia).

As of March 31, 2021, 16 of the 20 largest generic companies globally were its customers.

It currently operates four multi-purpose manufacturing facilities at Ankleshwar and Dahej in Gujarat, and Mohol and Kurkumbh in Maharashtra with an aggregate annual total installed capacity of 726.6 KL as of March 31, 2021.

The company intends to increase its API manufacturing capabilities at Ankleshwar facility during FY22, and Dahej facility during FY22 and FY23 by an aggregate annual total installed capacity of 200 KL. This additional production capacity is expected to help the company further expand generic API production and also grow oncology product pipeline.

Top Shareholdings:

Glenmark Pharmaceuticals is the promoter of the company, holding 100 percent of the pre-offer stake in Glenmark Life.

Objective of the issue:

The initial public offering comprises a fresh issue of Rs 1,060 crore and an offer for sale of up to 63 lakh equity shares by promoter Glenmark Pharmaceuticals. Glenmark Life Sciences will use the proceeds for

- payment of outstanding purchase consideration to the promoter for spin-off of the API business from the promoter into the company pursuant to the Business Purchase Agreement dated October 9, 2018 (Rs 800 crore),

- for funding capital expenditure requirements (Rs 152.76 crore), and

- for general corporate purposes.

Anchor Investors:

Raised Rs 454 crore from 19 anchor investors at Rs 720 a share – HSBC Global Investment Funds, Government Pension Fund Global, Oaktree Emerging Markets Equity Fund LP, Copthall Mauritius Investment Ltd -ODI account, Societe Generale-ODI, Kuber India Fund and Reliance General Insurance Company are among the anchor investors

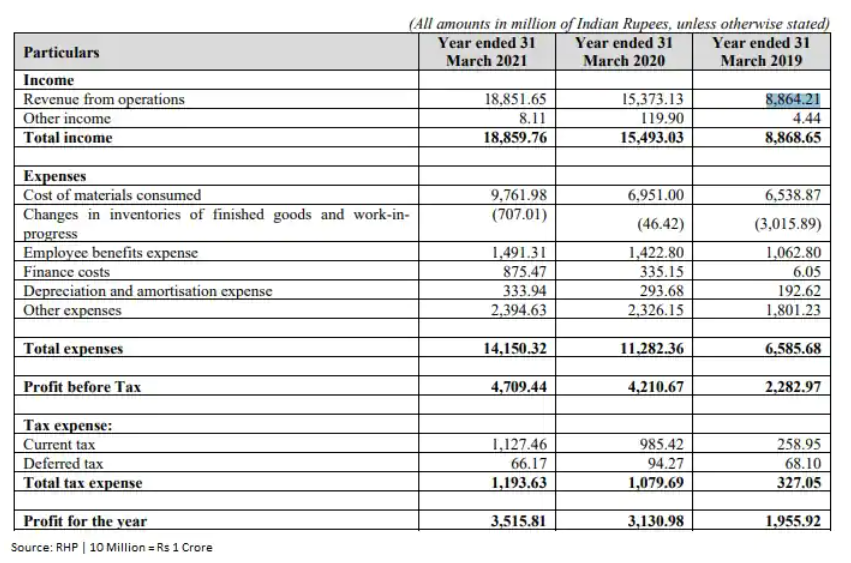

Financials:

| Revenue (Rs crores) | PAT (₹ Crores) | EPS (₹) | |

| Mar 2019 | 886.87 | 195.59 | 24.64 |

| Mar 2020 | 1,549.30 | 313.10 | 29.04 |

| Mar 2021 | 1,885.98 | 351.58 | 32.61 |

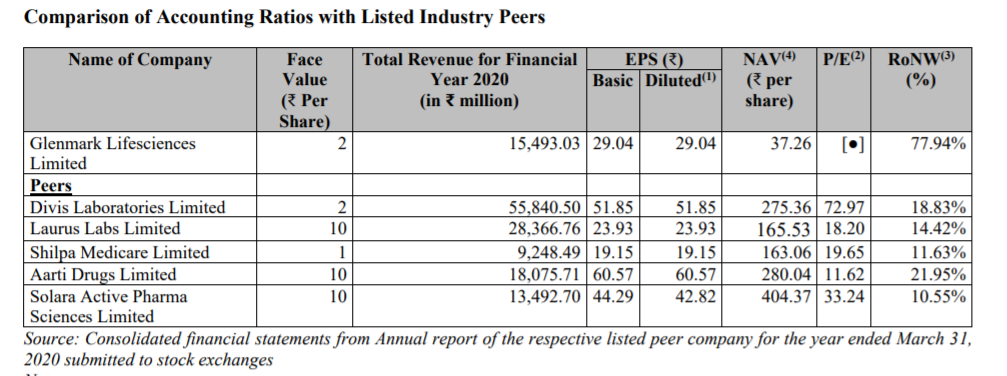

Valuation as compared to its peers:

Based on 2021 EPS and offer price, the PE ratio for Glenmark comes to 22.08.

Brokerage Recommendations:

| Brokerage | Recommendations |

| Religare Broking | Subscribe |

| Geojit | Subscribe |

| Sanctum Wealth | Subscribe |

| Angel Broking | Positive |

Important Dates:- IPO Schedule (Tentative)

| Finalization of Basis of Allotment | 3rd Aug |

| Initiation of Refunds | 4th Aug |

| Credit of Equity Shares: | 5th Aug |

| Listing Date: | 6th Aug |

Subscription Details: (Will be Updated)

| (Subscription-Category-Wise (no. of times) Till time : 06:00 PM) | Shares Offered | Day-1 | Day-2 | Day-3 |

|---|---|---|---|---|

| QIB | 0.98 | 13.31 | ||

| NII | 0.87 | 99.24 | ||

| Retail | 4.61 | 7.07 | ||

| Employee | ||||

| TOTAL | 2.78 | 28.67 |

Should you invest:

The company has demonstrated strong revenue and margin growth in the last 3 years. Also the issue is reasonably priced as compared to peers.

How to apply for Glenmark Life Sciences IPO through Zerodha

Zerodha customers can apply online in Glenmark Life Sciences IPO using UPI as a payment gateway. Zerodha customers can apply in Glenmark Life Sciences IPO by login into Zerodha Console (back office) and submitting an IPO application form.

- Visit the Zerodha website and login to Console.

- Go to Portfolio and click the IPOs link.

- Go to the ‘Glenmark Life Sciences IPO’ row and click the ‘Bid’ button.

- Enter your UPI ID, Quantity, and Price.

- ‘Submit’ IPO application form.

- Visit the UPI App (net banking or BHIM) to approve the mandate.

Disclaimer: This article is for educational purposes and should not be treated as investment advice. Please consult with your investment advisor before making any investment decisions.