Devyani International IPO is opening on 4th Aug 2021. Devyani International Limited is the largest franchisee of Yum Brands in India and is among the largest operators of quick service restaurants chain in India and operates 655 stores across 155 cities in India, as of March 31, 2021.

Issue Details of Devyani International IPO:

| IPO Opens on | 04 Aug 2021 |

| IPO Closes on | 06 Aug 2021 |

| Issue Price band | Rs 86 – Rs 90 |

| Any Discount | NA |

| Issue Size | Rs 1858 crore |

| Minimum Investment | 165 shares lot (min amount 14850) |

| Max Investment (Retail) | 13 lots / 2145 shares (amount Rs 1,93,050) |

| Registrar | Link Intime |

| Book Running Lead Managers | Kotak Mahindra Capital, CLSA |

| Listing | BSE/NSE |

| Download | Devyani International Red Herring Prospectus |

Some of the recently listed IPOs have given 100-300% returns in 2021. Also check the list of upcoming IPOs in 2021.

Background:

We are the largest franchisee of Yum Brands in India and are among the largest operators of chain quick service restaurants (“QSR”) in India (Source: GlobalData Report), on a non-exclusive basis, and operate 655 stores across 155 cities in India, as of March 31, 2021, and 696 stores across 166 cities in India, as of June 30, 2021. Yum! Brands Inc. operates brands such as KFC, Pizza Hut and Taco Bell brands and has presence globally with more than 50,000 restaurants in over 150 countries, as of December 31, 2021. In addition, we are a franchisee for the Costa Coffee brand and stores in India.

We had 692 stores as of March 31, 2021 and 735 stores as of June 30, 2021, across our operations, comprising KFC, Pizza Hut and Costa Coffee stores (“Core Brands”) as well as outlets of other brands such as Vaango. Revenue from our Core Brands Business, together with our International

Business, represented 83.01%, 82.94% and 94.19% of our revenue from operations in Fiscals 2019, 2020 and 2021,

respectively

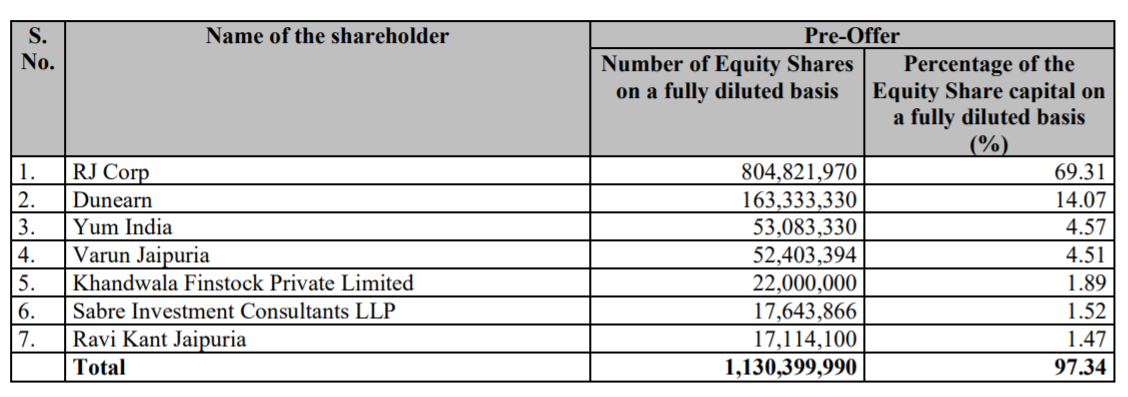

Top Shareholdings:

Objective of the issue:

- Offer for Sale: The Selling Shareholders will be entitled to their respective portion of the proceeds of the Offer for Sale after deducting their proportion of Offer expenses and relevant taxes thereon. Our Company will not receive any proceeds from the Offer for Sale and the proceeds received from the Offer for Sale will not form part of the Net Proceeds

- The Fresh Issue: Our Company proposes to utilise the Net Proceeds towards funding of the following objects:

1. Repayment/prepayment of all or certain of our borrowings; and

2. General corporate purposes

Anchor Investors:

- Devyani international raised Rs 824.87 crore from 63 anchor investors on August 3, a day before the opening of its initial public offering (IPO).

- The company in consultation with merchant bankers and selling shareholders, has finalised the allocation of 9,16,52,499 equity shares to anchor investors, at a price of Rs 90 per share, said Devyani International in a BSE filing.

- Prominent investors who participated in the anchor book include Abu Dhabi Investment Authority, Fidelity Funds, Goldman Sachs, Government of Singapore, Monetary Authority of Singapore, Mirae Asset, Nomura Trust, Private Client Emerging Markets Portfolio, NS Partners Trust, Neuberger Berman Investment, Kuwait Investment Authority Fund, Vantagetrust, Best Investment Corporation, CLSA, Carmignac Portfolio, and Affin Hwang Select Asia Quantum Fund.

- Domestic investors including SBI General Insurance, Bajaj Allianz Life Insurance, SBI Life Insurance, Aditya Birla Sun Life Insurance, Sundaram Mutual Fund, ICICI Prudential, Tata Mutual Fund, and HDFC Life Insurance also participated in the anchor book.

- “Out of the total allocation of 9,16,52,499 equity shares to anchor investors, 2,10,51,525 equity shares were allocated to 6 domestic mutual funds through a total of 28 schemes,” said the company.

IPO Issue Allocation:

- QIB = Not More than 50% of the offer

- NII = Not less than 15% of the offer

- Retail = Not less than 35% of the offer

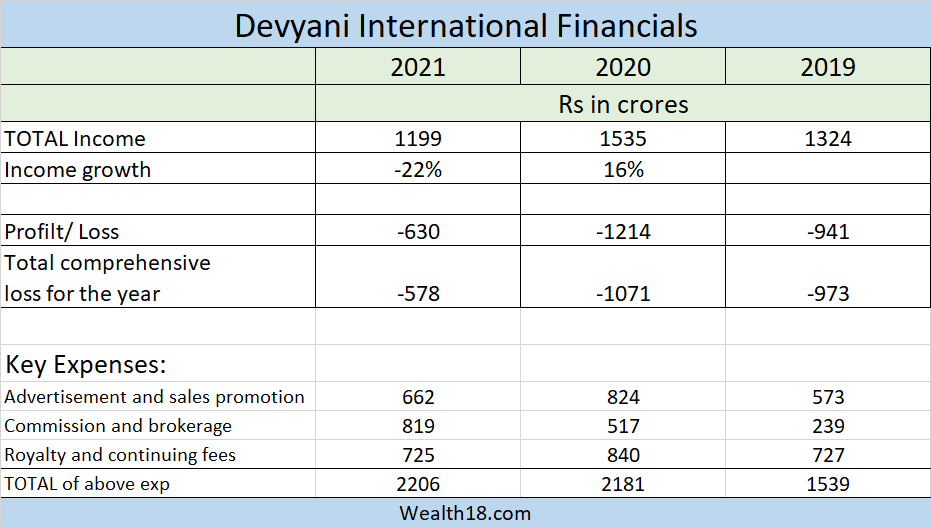

Financials:

Almost half of income goes into Royalty fees.

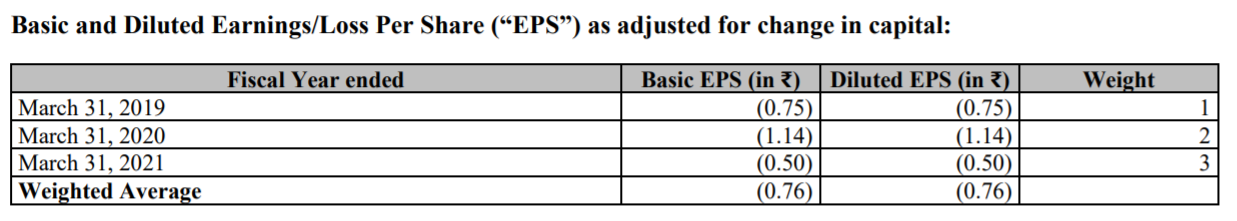

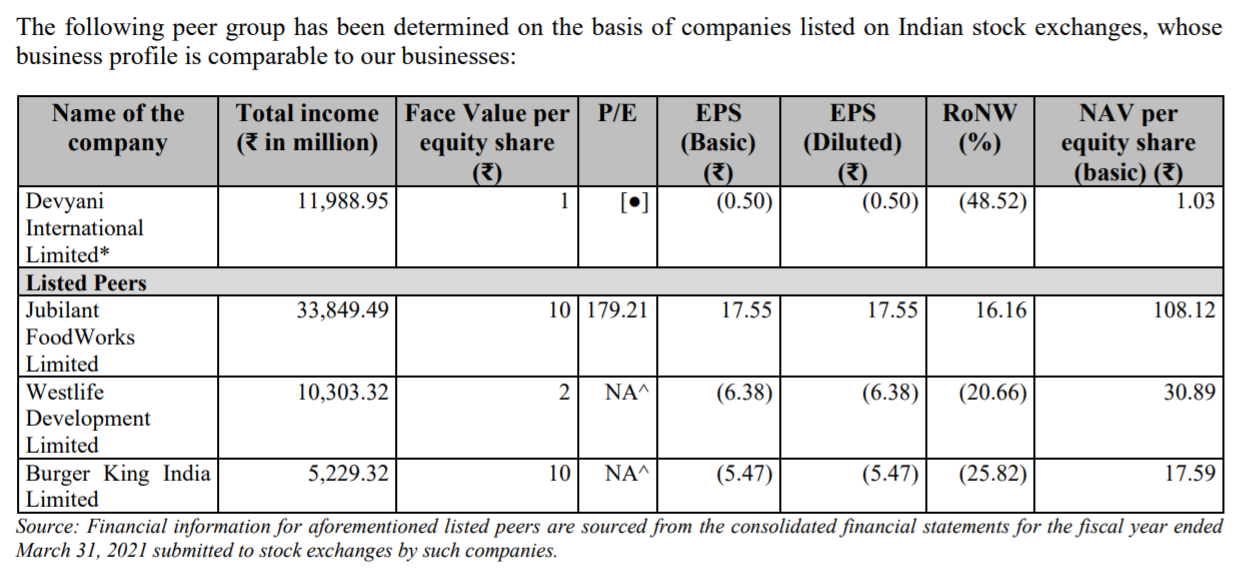

Valuation as compared to its peers:

At the upper end of the price band, Devyani is offered at 9.5x market capitalisation/sales as per FY21 financial statement, compared to peers like Jubilant Foodworks (15x), Westlife Development (8.8x), Burger King India (14x).

Brokerage Recommendations:

| Brokerage | Recommendations |

| Anand Rathi | Subscribe |

| Prabhudas Liladhar | Subscribe |

| LKP Research | Subscribe |

Devyani International IPO Grey market Premium :

- As per market observers, Devyani International grey market premium (GMP) was at around ₹40-45

Should you invest:

The company is one of the leading QSR player with highly recognized global brands. With more and more people ordering food or visiting restaurants, the growth in future seems promising. However, currently the company has net loss in last couple of years due to high advertisement cost, royalty fees and commissions.

The story is similar to other consumption companies like Zomato, Westlife (McDonalds, Burger King etc) which are in losses but investors are betting in long term growth.

With current euphoria in stock market and IPO listings, it is expected that this IPO will also see considerable interest. You can consider to invest in this IPO for listing gains.

Some of the recently listed IPOs have given 100-300% returns in 2021. Also check the list of upcoming IPOs in 2021.

Important Dates:- IPO Schedule (Tentative)

| Finalization of Basis of Allotment | August 11 |

| Initiation of Refunds | August 12 |

| Credit of Equity Shares: | August 13 |

| Listing Date: | August 16 |

Subscription Details: (Will be Updated)

| (Subscription-Category-Wise (no. of times) Till time : 06:00 PM) | Shares Offered | Day-1 | Day-2 | Day-3 |

|---|---|---|---|---|

| QIB | TBC | 95.3 | ||

| NII | TBC | 213 | ||

| Retail | TBC | 39.5 | ||

| Employee | TBC | 4.7 | ||

| TOTAL | TBC | 116.7 |

How to apply for Devyani International IPO through Zerodha

Zerodha customers can apply online in Devyani International IPO using UPI as a payment gateway. Zerodha customers can apply in Devyani International IPO by login into Zerodha Console (back office) and submitting an IPO application form.

- Visit the Zerodha website and login to Console.

- Go to Portfolio and click the IPOs link.

- Go to the ‘Devyani International IPO’ row and click the ‘Bid’ button.

- Enter your UPI ID, Quantity, and Price.

- ‘Submit’ IPO application form.

- Visit the UPI App (net banking or BHIM) to approve the mandate.

Disclaimer: This article is for educational purposes and should not be treated as investment advice. Please consult with your investment advisor before making any investment decisions.