Anand Rathi Wealth is one of the leading non-bank wealth solutions firms in India and have been ranked amongst one of the three largest non-bank mutual fund distributors in India by gross commission earned in Fiscal 2019, 2020 and 2021. The company serve a wide spectrum of clients through a mix of wealth solutions, financial product distribution and technology solutions.

Issue Details of Anand Rathi Wealth IPO:

| IPO Opens on | 02 Dec 2021 |

| IPO Closes on | 06 Dec 2021 |

| Issue Price band | Rs 530 – Rs 550 |

| Any Discount | NA |

| Issue Size | Rs 660 crore |

| Market Capitalisation | approx Rs XXX crores |

| Minimum Investment | 27 shares lot (min amount 14850) |

| Max Investment (Retail) | 13 lots / 351 shares (amount Rs 1,93, 050) |

| Registrar | Link Intime |

| Book Running Lead Managers | BNP Paribas, Equirus Capital |

| Listing | BSE/NSE |

| Download | Red Herring Prospectus |

LatentView Analytics Grey market Premium :

- As per market observers, grey market premium (GMP) was at around ₹85-90

[sc name=”ad1″][/sc]

IPO Issue Allocation:

- QIB = Not More than 50% of the offer

- NII = Not less than 15% of the offer

- Retail = Not less than 35% of the offer

Background:

The company provide services primarily through our flagship Private Wealth (“PW”) vertical where we manage ₹ 294.72 billion in AuM as on August 31, 2021. Our Company:

- (a) acts as a mutual fund distributor, registered with the Association of Mutual Funds in India. It distributes mutual fund schemes managed by asset management companies and earns distribution commissions on a trail basis from asset management companies;

- (b) purchases non-convertible market linked debentures (“MLDs”) and offers them to its clients and earns income from these sales.

Therefore, the AUM of our Company comprises mutual fund schemes and other financial products such as bonds, MLDs and other securities held by clients in their own demat accounts.

As on August 2021, the company’s flagship Private Wealth vertical catered to 6,564 active client families across the country, serviced by a team of 233 relationship managers. In addition to the Private Wealth vertical, the company has two new age technology led business verticals– Digital Wealth and Omni Financial Advisors.

Since March 31, 2019 until August 31st this year, the company’s Asset Under Management (AUM) has grown at a CAGR (Compound Annual Growth Rate) of 22.74 per cent to ₹302.09 billion.

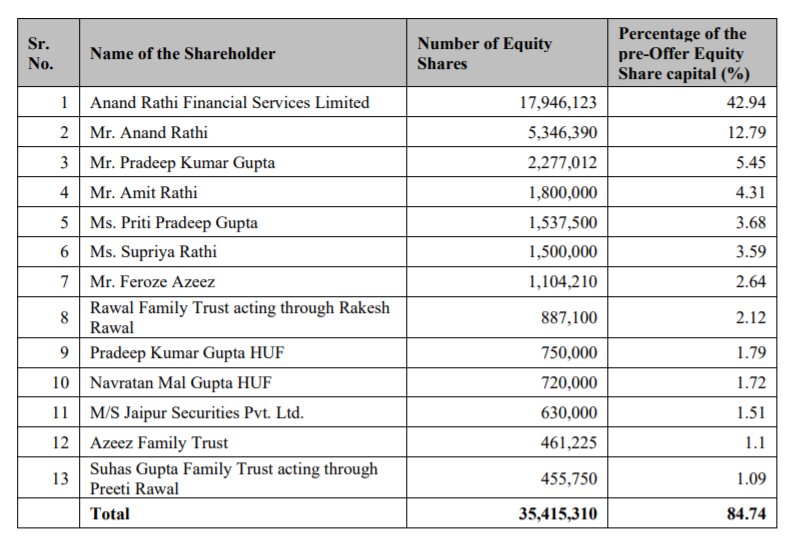

Top Shareholdings:

Objective of the issue:

The objects of the offer are to achieve the benefits of listing the equity shares on the stock exchanges. The OFS consists of sale of 92.85 lakh equity shares by Anand Rathi Financial Services, and 3.75 lakh equity shares each by Anand Rathi, Pradeep Gupta, Amit Rathi, Priti Gupta, Supriya Rathi, Rawal Family Trust, and Feroze Azeez, and 90,000 equity shares by Jugal Mantri.

Earlier in September 2018, the company had filed draft papers with Sebi to raise ₹425 crore through an IPO. However, the firm later withdrew its proposed public issue.

Anchor Investors:

Anchor investors are big institutional investors and have a 30-day lock-in period which means they can’t sell their shares before 30 days from the date of allotment.

Ahead of its IPO, Anand Rathi Wealth mobilised Rs 194 crore from 19 anchor investors . Investors that participated in the anchor book are SBI Mutual Fund, ICICI Prudential, Franklin India Smaller Companies Fund, DSP Smallcap Fund, Kotak Mutual Fund, Canara Robeco Mutual Fund, Invesco India Tax Plan, Nippon Life, Abakkus Growth Fund-1, Quant Mutual Fund, and Cohesion MK Best Ideas.

[sc name=”ad1″][/sc]

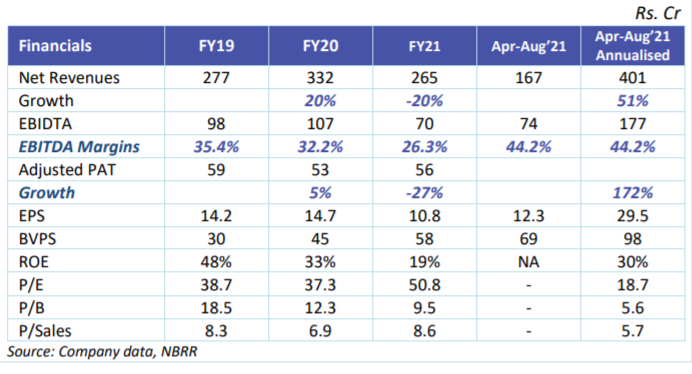

Financials:

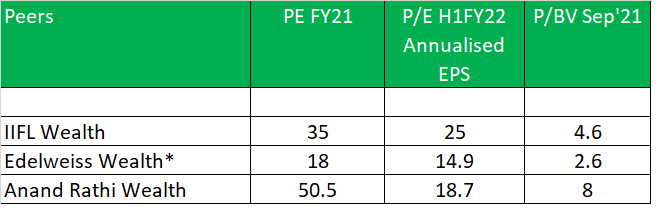

Valuation as compared to its peers:

Given the fundamentals and growth potential, valuation of (ARWL) looks reasonable, as at upper end of price band, the company is valued at ~7.5% AUM and ~18.7x EPS (annualised FY22E).

Strengths:

- Focus on the underserved and less price sensitive HNI segment

- Presence in Structured Products or Non-Convertible Market Linked Debentures

- Uncomplicated, holistic and standardized solutions offered to clients based on an objective-driven approach

- Focus on safety net and estate planning services provides value addition to clients

Cons:

- High competition from existing and new market participants:

- Volatility in the securities market

Brokerage Recommendations

| Nirmal Bang | Subscribe |

| ICICI Direct | Subscribe |

Should you invest:

Several brokerages have shared a positive review of the Anand Rathi Wealth IPO citing strong fundamentals, healthy return rations and growth of assets under management (AUM). However, note that the company has less bargaining power in terms of commission.

Investors can consider avoiding this IPO as the business has less bargaining power and also over long term the commission % on mutual funds and wealth business may reduce (as more investors will move for direct MF schemes and robo investment advice).

Important Dates:- IPO Schedule (Tentative)

| Finalization of Basis of Allotment | Dec 9, 2021 |

| Initiation of Refunds | Dec 10, 2021 |

| Credit of Equity Shares: | Dec 13, 2021 |

| Listing Date: | Dec 14, 2021 |

Subscription Details: (Will be Updated)

| (Subscription-Category-Wise (no. of times) Till time : 06:00 PM) | Shares Offered | Day-1 | Day-2 | Day-3 |

|---|---|---|---|---|

| QIB | 0.17 | |||

| NII | 3.06 | |||

| Retail | 4.77 | |||

| Employee | 0.66 | |||

| TOTAL | 3.02 |

How to apply for Anand Rathi Wealth through Zerodha

Zerodha customers can apply online in this IPO using UPI as a payment gateway. Zerodha customers can apply in this IPO by login into Zerodha Console (back office) and submitting an IPO application form.

- Visit the Zerodha website and login to Console.

- Go to Portfolio and click the IPOs link.

- Go to the ‘Anand Rathi Wealth IPO’ row and click the ‘Bid’ button.

- Enter your UPI ID, Quantity, and Price.

- ‘Submit’ IPO application form.

- Visit the UPI App (net banking or BHIM) to approve the mandate.

Disclaimer: This article is for educational purposes and should not be treated as investment advice. Please consult with your investment advisor before making any investment decisions.