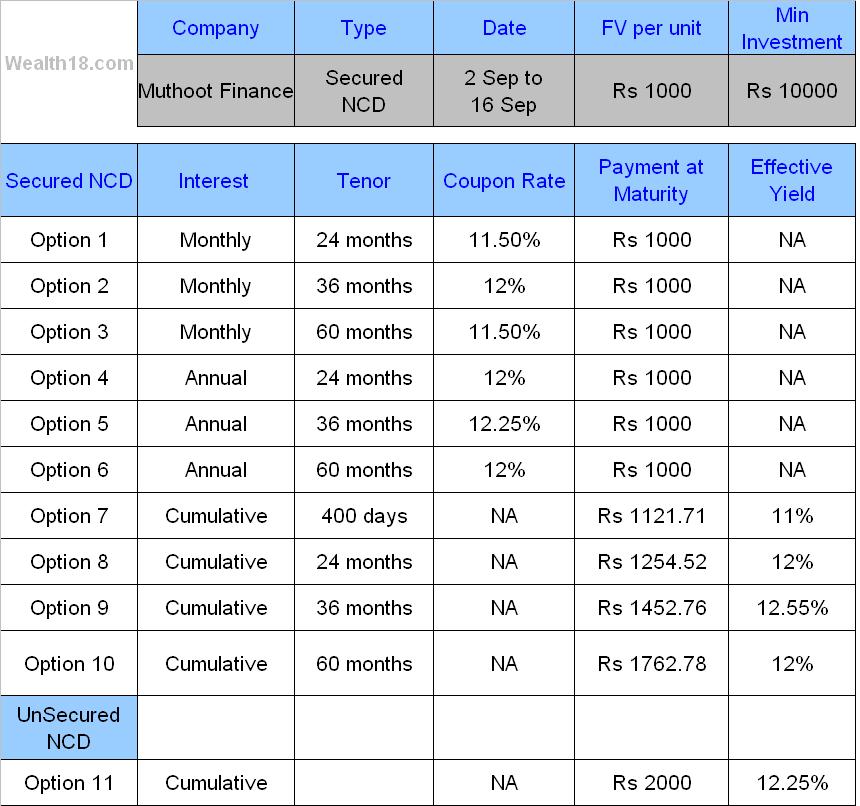

Muthoot Finance has opened its public issue of NCDs on 2-Sep-2013 & it closes on 16-Sep-2013 offering 11 investment options with yield upto 12.55%

Type of Instruments – Secured & UnSecured Redeemable NCDs

Size of Issue – Rs 150 crore through this issue, with an option to retain oversubscription upto Rs 150 crore, aggregating to a total of upto Rs 300 crore.

Listing – Proposed to be listed on BSE

Credit Rating – AA-/negative by CRISIL and AA-/negative by ICRA .

Investment options – Monthly / Annually / Cumulative Interest for 24 months, 36 months, 60 months , 72 months

About Company

Muthoot Finance is the largest gold financing company in India in terms of loan portfolio.

The company provides personal and business loans secured by gold jewellery, or gold loans, primarily to individuals who possess gold jewellery, but could not access formal credit within a reasonable time, or to whom credit may not be available at all, to meet unanticipated or other short-term liquidity requirements.

As of June 30, 2013, the company has branch network of 4163 branches. Its gold loan portfolio as of March 31, 2013 comprised approximately 6.5 million loan accounts.

The funds raised through this issue will be utilised by the company for various financing activities including lending and investments, to repay existing liabilities or loans and towards business operations including for capital expenditure, working capital requirement and other general corporate purposes.

The gold loan industry has seen a slowdown in business after the sharp fall in gold prices earlier this year coupled with a barrage of restrictions aimed at lowering the overall demand for gold in the country. As a result, assets under management or gross loans grew merely 7% in FY13 compared with 55% in FY12.

Taxation Aspects

- NCDs taken in the demat form will NOT attract any TDS on the interest income. However, if NCD are taken in physical form, TDS will be applicable if the interest amount exceeds Rs. 5,000

| Interest earned on NCD | Taxable as per tax slab of Investor |

| If sold on exchange (before 12 months) | Short term capital gain / loss |

Taxable as per tax slab of InvestorIf sold on exchange (after 12 months)Long term capital gain / loss

Taxable @ 10.30% without indexation

Positive Points

- High Yiled of AA- instrument

- If you fall in the lower tax bracket, post-tax returns for some options in this NCD are superior than that of tax-free bonds.

Negative factors

- For an investor in the highest tax bracket, it doesn’t make sense to invest in these as the net returns are comparable with that of the tax-free bonds.

- NCDs are illiquid. If the interest rates fall, it may be difficult for investors to capitalise on falling interest rates. If you invest in govt bonds / short medium term debt funds, and if the interest fall in 2-3 years time frame, they may give you better returns than these NCD offering 12.5%.

How to Apply

- Physical Form – You can download the Form and submit to designated bank branches alongwith cheque. Muthoot Finance NCD Application Form Download

- Online – You can invest online in DMAT form through your online share trading account or through your broker.

Summary

- Investors in lower tax slab can consider investing in these NCD, but not more than 10% of their debt allocation.

- Investors in the 30% tax bracket should invest in tax-free bonds or go for debt funds or FMPs