Latent View provides analytics services such as data and analytics consulting, business analytics & insights, advanced predictive analytics, data engineering, and digital solutions. The company provides services to blue-chip companies in Technology, BFSI, CPG & Retail, Industrials, and other industry domains.

Issue Details of LatentView Analytics IPO:

| IPO Opens on | 10 Nov 2021 |

| IPO Closes on | 12 Nov 2021 |

| Issue Price band | Rs 190 – Rs 197 |

| Any Discount | NA |

| Issue Size | Rs 622 crore |

| Market Capitalisation | approx Rs XXX crores |

| Minimum Investment | 76 shares lot (min amount 14972) |

| Max Investment (Retail) | 13 lots / 988 shares (amount Rs 1,94,636) |

| Registrar | Link Intime |

| Book Running Lead Managers | Axis Capital, ICICI Sec |

| Listing | BSE/NSE |

| Download | Red Herring Prospectus |

LatentView Analytics Grey market Premium :

- As per market observers, grey market premium (GMP) was at around ₹XX

[sc name=”ad1″][/sc]

IPO Issue Allocation:

- QIB = Not More than 70% of the offer

- NII = Not less than 15% of the offer

- Retail = Not less than 15% of the offer

Background:

Latent View provides analytics services such as data and analytics consulting, business analytics & insights, advanced predictive analytics, data engineering, and digital solutions. The company provides services to blue-chip companies in Technology, BFSI, CPG & Retail, Industrials, and other industry domains.

The company classifies its business into –

(i) Consulting services, which involves understanding relevant business trends, challenges, and opportunities and preparing a roadmap of data and analytics initiatives that addresses them;

(ii) Data engineering, to design, architect, and implement the data foundation required to undertake analytics;

(iii) Business analytics, which delivers analysis and insights for clients to make more accurate, timely and impactful decisions; and

(iv) Digital solutions which the company develops to automate business processes, predict trends and generate actionable insights.

The company has a presence across countries in the United States, Europe, and Asia through their subsidiaries in the United States, Netherlands, Germany, United Kingdom, and Singapore, and their sales offices in San Jose, London, and Singapore. Latent View has worked with over 30 Fortune 500 companies in the last three fiscals and some of the key clients include Adobe, Uber Technology, and 7-Eleven.

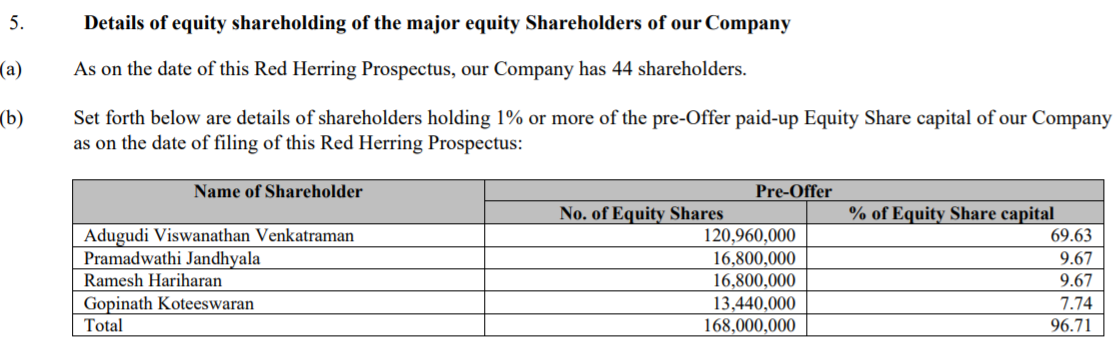

Top Shareholdings:

Objective of the issue:

Our Company proposes to utilise the Net Proceeds of the Fresh Issue towards funding the following objects:

1. Funding inorganic growth initiatives;

2. Funding working capital requirements of LatentView Analytics Corporation, our Material Subsidiary;

3. Investment in our Subsidiaries to augment their capital base for future growth; and

4. General corporate purposes (collectively, referred to herein as the “Objects”).

Anchor Investors:

Anchor investors are big institutional investors and have a 30-day lock-in period which means they can’t sell their shares before 30 days from the date of allotment.

[sc name=”ad1″][/sc]

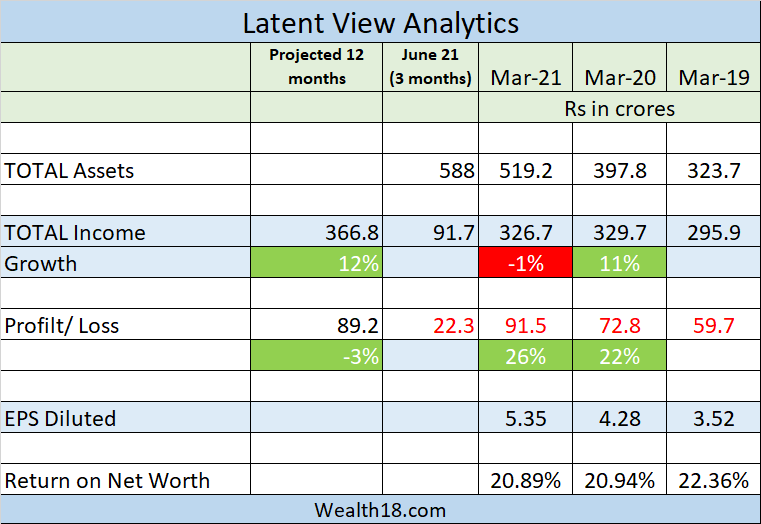

Financials:

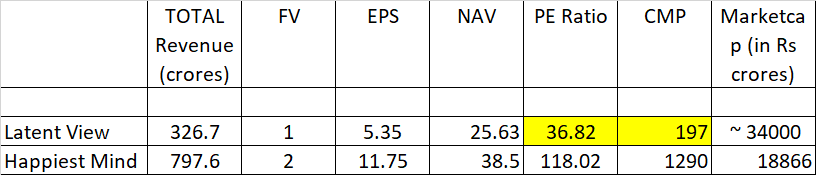

Valuation as compared to its peers:

Company is asking IPO price in the P/E range of 38.6x to 44.5x. As per RHP there is only one listed peer, Happiest Minds Technologies who are in similar business which is trading at P/E 118x.

Strengths:

- one of the leading data analytics companies in India.

- bluechip clients

- Company has stable revenue growth and good margins

Cons:

- 90% of its revenue from clients located in USA

- 55% of the revenue comes from Top 5 customers, so concentration risk.

Should you invest:

As the company is leading dat analytics players, has income growth and stable margin, reasonable valuation, investors can consider investing in this IPO from medium to long term.

Important Dates:- IPO Schedule (Tentative)

| Finalization of Basis of Allotment | Nov 16, 2021 |

| Initiation of Refunds | Nov 17, 2021 |

| Credit of Equity Shares: | Nov 18, 2021 |

| Listing Date: | Nov 22, 2021 |

Subscription Details: (Will be Updated)

| (Subscription-Category-Wise (no. of times) Till time : 06:00 PM) | Shares Offered | Day-1 | Day-2 | Day-3 |

|---|---|---|---|---|

| QIB | ||||

| NII | ||||

| Retail | ||||

| Employee | ||||

| TOTAL |

How to apply for LatentView Analytics through Zerodha

Zerodha customers can apply online in this IPO using UPI as a payment gateway. Zerodha customers can apply in this IPO by login into Zerodha Console (back office) and submitting an IPO application form.

- Visit the Zerodha website and login to Console.

- Go to Portfolio and click the IPOs link.

- Go to the ‘LatentView Analytics IPO’ row and click the ‘Bid’ button.

- Enter your UPI ID, Quantity, and Price.

- ‘Submit’ IPO application form.

- Visit the UPI App (net banking or BHIM) to approve the mandate.

Disclaimer: This article is for educational purposes and should not be treated as investment advice. Please consult with your investment advisor before making any investment decisions.