Sheela Foam’s (Sleepwell Mattress) has announced its IPO which will open on 29th Nov.

Issue Details of Sheela Foam / Sleepwell Mattress IPO:

- IPO Open : 29th Nov to 1st Dec

- Issue Price band: Rs 680 – 730 per share

- Issue Size: Rs 510 crores

- Market lot : 20 shares

- Minimum Investment: Rs 14600 (Upper band)

- Book Running Lead Managers : Edelweiss Sec & ICICI Sec

- Registrar –

- Listing: BSE/NSE

IPO Issue Allocation

- Qualified institutional buyers (QIBs) – 50% of the total issue size.

- Non-institutional investors (NIIs) – 15% of the issue size.

- The retail quota limit in the issue = 35% of the issue size.

Background:

Sheela Foam is the leading manufacturer of mattresses (incorporated in 1971) marketed under “SleepWell” brand. It also manufactures foam-based home comfort products like mattresses, furniture-cushioning, pillows, cushions and sofa-cum-beds.

The company, which has 12 manufacturing facilities, developed a pan-India distribution network consisting of over 100 exclusive distributors, more than 2,000 exclusive retail dealers and over 2,500 multi-brand outlets. The firm exports its products to 25 countries.

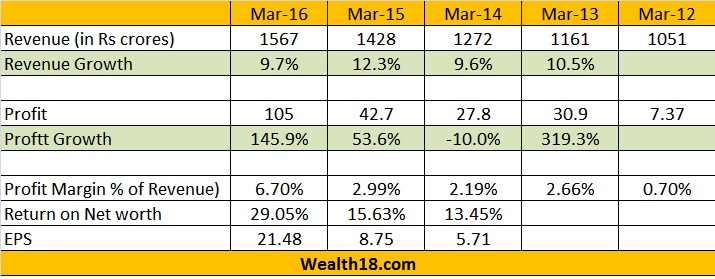

Sheela owns 20%-23% of the organized mattress market and has seen a compounded revenue growth of 10% from FY12-FY16

While 82% of Sheela’s revenues are from domestic markets, 18% come from exports of technical foam. It also has presence in Australia through its wholly owned subsidiary – Joyce Foam.

Promoters holdings:

- 72% is owned by Sheela, Rahul & Namita, Tushaar Gautam

- 28% is owned by Polyflex Marketing

Objective of the issue:

Sheela Foam IPO is actually an Offer for Sale (OFS) by promoter Polyflex Marketing Pvt. Ltd. Thus whole sale proceeds will go to them and the company will not receive any proceeds from the offer.

Anchor Investors: Will be available one day before the IPO opens.

Financials: In the first half of FY17, consolidated net profit was Rs 66 crore on sales of Rs 796 crore. Its EBIDTA (earnings before interest depreciation and tax) margin was at 13.2%.

Risks: Company’s EBIDTA and PAT margins were very low till FY 2015.

Company has experienced negative cash flows in relation to investing activities and financing activities for Fiscal Years 2014, 2015 and 2016.

Valuation as compared to its peers: Since there are no listed companies in India that are engaged in the company’s line of business, comparison cannot be done.

The company’s 2016 EPS is 21.48 and on that basis the PE ratio is 34 times. But the last year profit is high as compare to previous years.

The average EPS for last 3 years is 12 and on that basis the PE ratio comes to 61 times.

Both 34 times or 61 times are very high valuation, specially when revenue growth is just 10% year on year.

[xyz-ihs snippet=”ad1″]

Should you invest:

I believe that valuation is quite high, the profit margin is inconsistent and the revenue growth is low.

Based on these factors, you should avoid this issue.

Disclaimer: The articles or analysis on this website should not be constituted as Investment advice. Please consult your financial advisor before making any investments.