9.50% IFCI secured redeemable non-convertible debentures (NCD) Issue January 2015

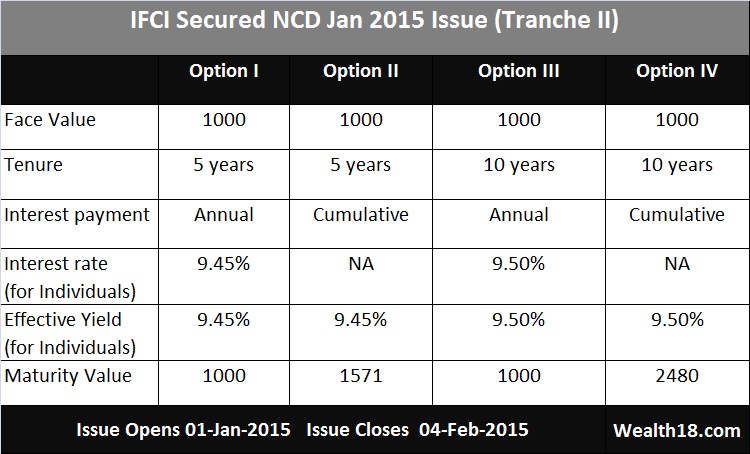

IFCI has opened its public issue of NCDs Tranche II on 01-Jan-2015 & it closes on 04-Feb-2015 offering 8 investment options with yield upto 9.50% . This is the second NCD issue by IFCI with previous one issued in Oct 2014.

Type of Instruments – Public issue of the secured redeemable non-convertible debentures (NCD)

Size of Issue –Rs. 250 crore with an option to retain oversubscription up to the residual shelf limit of Rs. 790.81 crore

Listing – Proposed to be listed on NSE & BSE (within 12 working days of closing the issue)

Credit Rating – Brickwork Ratings ‘AA-’ with ‘Stable’ outlook, ICRA ‘A’ with a ‘Stable’ outlook. These NCDs are ‘Secured’ in nature and in case of any default in payment, the investors will have the right to claim their money against certain receivables of IFCI.

NRI – Non Resident Indian (NRI) cannot invest in this issue

Investment options – Annually / Cumulative Interest for 5 years & 10 years

Minimum & Maximum Investment – 10 NCD of Rs 1000 each = Rs 10000 . Under Retail Category (IV), maximum Investment is Rs 2 Lakh. Amount above that will be qualified as HNI (III) without any limit.

Allotment Method – First come First Service – 25% Issue is reserved for Retail Individual Investors

About Company

IFCI is Systematically Important Non-Deposit taking Non-Banking Finance Company and notified as a public financial institution. 55% shareholding is owned by Government of India. IFCI is Government of India controlled company, registered with the Reserve Bank of India (RBI) as a Systemically Important Non-Deposit taking NBFC (NBFC-ND-SI).

Along with the group entities, the company provide financial services which include, besides long term corporate loans, advisory services in the areas of Project Development, Project Appraisal, Strategic Analysis, Corporate Restructuring, Infrastructure Financing and Legal Advisory to certain sectors. The advisory services include bid process management, disinvestment advisory, techno-economic viability study, legal due diligence, financial advisory, valuation, financial appraisal, financial due diligence and project feasibility studies in core infrastructure sectors like power generation and transmission, oil & gas, mining, etc.

The funds raised will be used for purpose of lending/ repayment of the loan: minimum 75% of the net amount raised and allotted in the Issue; and For General Corporate purpose: upto 25% of the net amount raised and allotted in the Issue.

Taxation Aspect

NCDs taken in the demat form will NOT attract any TDS on the interest income. However, if NCD are taken in physical form, TDS will be applicable if the interest amount exceeds Rs. 5,000

| Internest earned on NCD | Taxable as per tax slab of Investor |

| If sold on exchange (before 12 months) | Short term capital gain / loss Taxable as per tax slab of Investor |

| If sold on exchange (after 12 months) | Long term capital gain / loss Taxable @ 10.30% without indexation |

In case of an individual or HUF, being a resident, where the total income as reduced by such long-term capital gains is below the maximum amount which is not chargeable to income-tax, then, such long-term capital gains shall be reduced by the amount by which the total income as so reduced falls short of the maximum amount which is not chargeable to income-tax and the tax on the balance of such long-term capital gains shall be computed at the rate mentioned above.

Under Section 54EC of the I.T. Act, long term capital gains arising to the debenture holders on transfer of their debentures in the company shall not be chargeable to tax to the extent such capital gains are invested in certain notified bonds within six months after the date of transfer.

As per the provisions of Section 54F of the I.T. Act, any long-term capital gains on transfer of a long term capital asset (not beingresidential house) arising to a Debenture Holder who is an individual or Hindu Undivided Family, is exempt from tax if the entire net sales consideration is utilized, within a period of one year before, or two years after the date of transfer, in purchase of a new residential house, or for construction of residential house within three years from the date of transfer.

Positive Points

- Medium Yield . Better Interest rates than Banks (FD rates are normally 8.75%)

- Safety of capital as Government of India owned enterprise

- If you fall in the lower tax bracket, post-tax returns for some options in this NCD are superior than that of tax-free bonds.

Negative factors

- For an investor in the highest tax bracket, it doesn’t make sense to invest in these as the net returns are comparable with that of the tax-free bonds.

- NCDs are not very liquid. Though they are listed on exchanges but trading volumes are low to get right price.

- Company business is very much influenced by interest rates scenario & government’s policies

How to Apply

- Physical Form – You can download the Form and submit to designated bank branches alongwith cheque. (Link to download IFCI NCD 2015 Form)

- Online – You can invest online in DMAT form through your online share trading account or through your broker.

Summary

- Investors in lower tax slab can consider investing in these NCD, but not more than 10% of their debt allocation.

- Investors in the 30% tax bracket should invest in tax-free bonds or go for debt funds.