Rategain Travel Technologies Ltd. (RTTL) is among the leading distribution technology companies globally and is the largest Software as a Service (“SaaS”) company in the hospitality and travel industry in India. The company offers travel and hospitality solutions across a wide spectrum of verticals including hotels, airlines, online travel agents (“OTAs”), meta-search companies, vacation rentals, package providers, car rentals, rail, travel management companies, cruises and ferries. RTTL is one of the largest aggregators of data points in the world for the hospitality and travel industry.

Issue Details of Rategain Travel Tech IPO:

| IPO Opens on | 07 Dec 2021 |

| IPO Closes on | 09 Dec 2021 |

| Issue Price band | Rs 405- Rs 425 |

| Any Discount | NA |

| Issue Size | Rs 1354 crore |

| Market Capitalisation | approx Rs XXX crores |

| Minimum Investment | 35 shares lot (min amount 14875) |

| Max Investment (Retail) | XX lots / XX shares (amount Rs XX) |

| Registrar | KFin |

| Book Running Lead Managers | IIFL, Kotak Mahindra Cap |

| Listing | BSE/NSE |

| Download | Red Herring Prospectus |

Rategain Travel Tech Grey market Premium :

- As per market observers, grey market premium (GMP) was at around ₹85-90

[sc name=”ad1″][/sc]

IPO Issue Allocation:

- QIB = Not More than 50% of the offer

- NII = Not less than 15% of the offer

- Retail = Not less than 35% of the offer

Background:

As of September 30, 2021, RTTL served 1,462 customers including eight Global Fortune 500 companies. Its customers include Six Continents Hotels, Inc., an InterContinental Hotels Group Company, Kessler Collection, a luxury hotel chain, Lemon Tree Hotels Limited and Oyo Hotels and Homes Private Limited. It also counts 1,220 large and mid-size hotel chains, 110 travel partners including airlines, car rental companies and large cruise companies and over 132 distribution partners including OTAs such as GroupOn and distribution companies such as Sabre GLBL Inc., in over 110 countries as its customers, as of September 30, 2021.

RTTL services its customers in multiple geographies with local go-to-market teams and as of September 30, 2021, have offices in six countries. As of September 30, 2021, over 415 customers have been associated with it for over five years and it has grown its customer base over the years through well-developed sales, customer success and marketing function that focuses on generating and converting quality sales leads and measuring customer satisfaction. It covered over 194,000 hotel properties with over 70 demand partners, as of September 30, 2021.

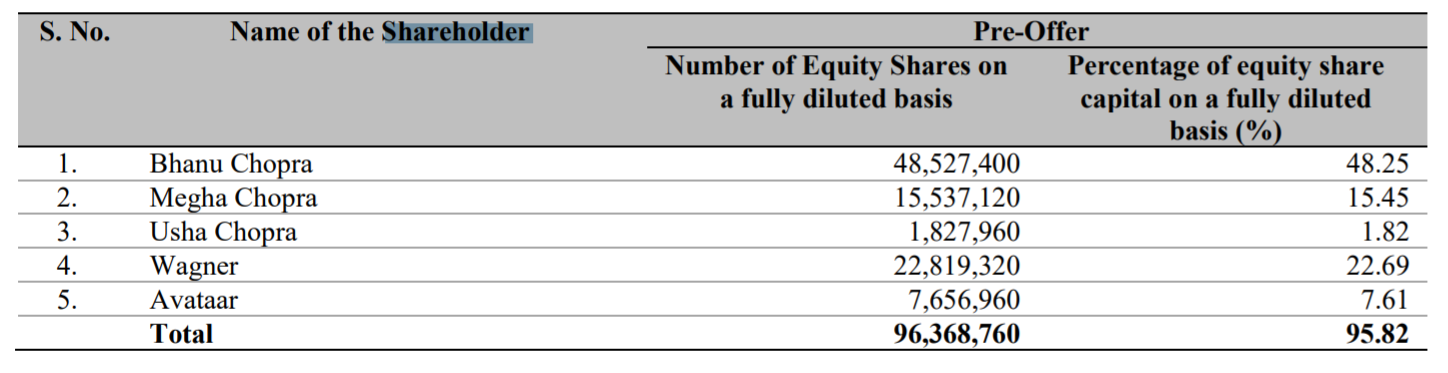

Top Shareholdings:

Objective of the issue:

.RateGain IPO Size is Rs 1,335.74 Crores and has below objects of the IPO:

1) Offer for Sale (OFS) Rs 960.74 Crores: Under OFS, selling shareholders would sell their shares and company would not get any money from this IPO proceeds.

2) Fresh issue of Rs 375 Crores: Fresh issue would be done towards the following purposes:

- Repayment and/or prepayment of indebtedness availed by Rategain UK.

- Make payment of deferred consideration for acquisition of DHISCO.

- Strategic investments, acquisition, and inorganic growth.

- To make an investment in technology innovation, artificial intelligence, and other organic growth initiatives.

- Purchase capital equipment for the company’s data center, and

- Meet general corporate purposes

Anchor Investors:

Anchor investors are big institutional investors and have a 30-day lock-in period which means they can’t sell their shares before 30 days from the date of allotment.

<will be updated on 6th Dec>

[sc name=”ad1″][/sc]

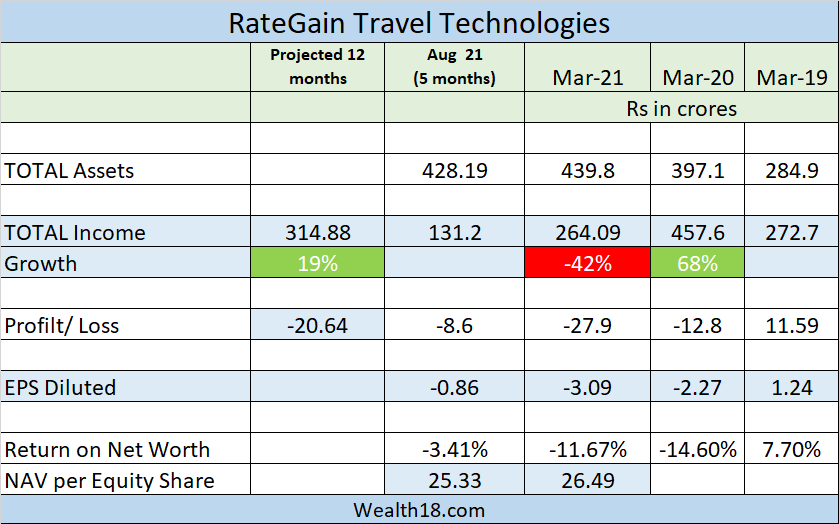

Financials:

Valuation as compared to its peers:

Company do not have any listed peers for comparison. Company is incurring losses and the EPS is negative in the last 3 years (weighted average) and in FY21, hence we cannot compute the P/E and cannot ascertain whether the issue price is underpriced or overpriced.

Strengths:

- Strong customer base

Cons:

- Short to medium term impact due to covid-19 impact and travel restrictions across the globe

- Loss making company

Brokerage Recommendations

| TBC | Subscribe |

| TBC | Subscribe |

Should you invest:

AVOID – Investors can consider avoiding this IPO as the company is loss making and there will be medium term impact due to Covid restrictions.

[sc name=”ad1″][/sc]

Important Dates:- IPO Schedule (Tentative)

| Finalization of Basis of Allotment | Dec 9, 2021 |

| Initiation of Refunds | Dec 10, 2021 |

| Credit of Equity Shares: | Dec 13, 2021 |

| Listing Date: | Dec 14, 2021 |

Subscription Details: (Will be Updated)

| (Subscription-Category-Wise (no. of times) Till time : 06:00 PM) | Shares Offered | Day-1 | Day-2 | Day-3 |

|---|---|---|---|---|

| QIB | ||||

| NII | ||||

| Retail | ||||

| Employee | ||||

| TOTAL |

How to apply for Rategain Travel Tech through Zerodha

Zerodha customers can apply online in this IPO using UPI as a payment gateway. Zerodha customers can apply in this IPO by login into Zerodha Console (back office) and submitting an IPO application form.

- Visit the Zerodha website and login to Console.

- Go to Portfolio and click the IPOs link.

- Go to the ‘RateGain Travel tech IPO’ row and click the ‘Bid’ button.

- Enter your UPI ID, Quantity, and Price.

- ‘Submit’ IPO application form.

- Visit the UPI App (net banking or BHIM) to approve the mandate.

Disclaimer: This article is for educational purposes and should not be treated as investment advice. Please consult with your investment advisor before making any investment decisions.