The Income Tax department has launched another option for online validation of tax returns and to enhance paperless regime of filing the annual IT returns.

This new option is – Bank account-based validation system for filing e-ITRs. This option is helpful for taxpayers who donot have or use net banking facility. Electronic Verification Code (EVC) can be generated by pre-validating your bank account on the e-filing website.

Punjab National Bank (PNB) is the first bank to do so and other banks are also “expected to launch this facility” for those taxpayers who have not availed e-banking facility.

The facility will be available on the official e-filing portal of the department- https://incometaxindiaefiling.gov.in/ . This will work similar to the One Time Password ( OTP) verification system as activated by the the tax department last year by using the Aadhaar number.

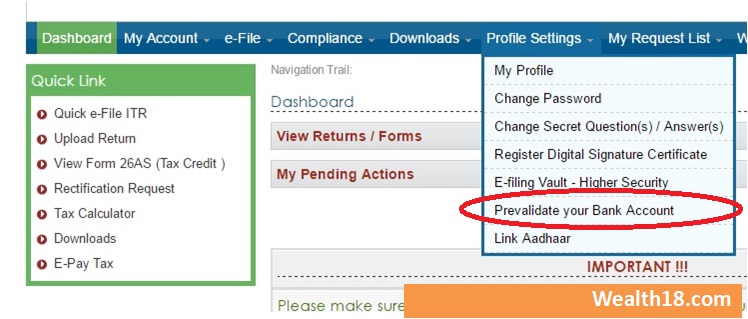

How to pre-validate your Bank account for EVC

Step 1: Pre-validate your Bank Account : Login to Income Tax efiling portal & click on “Profile Setting”

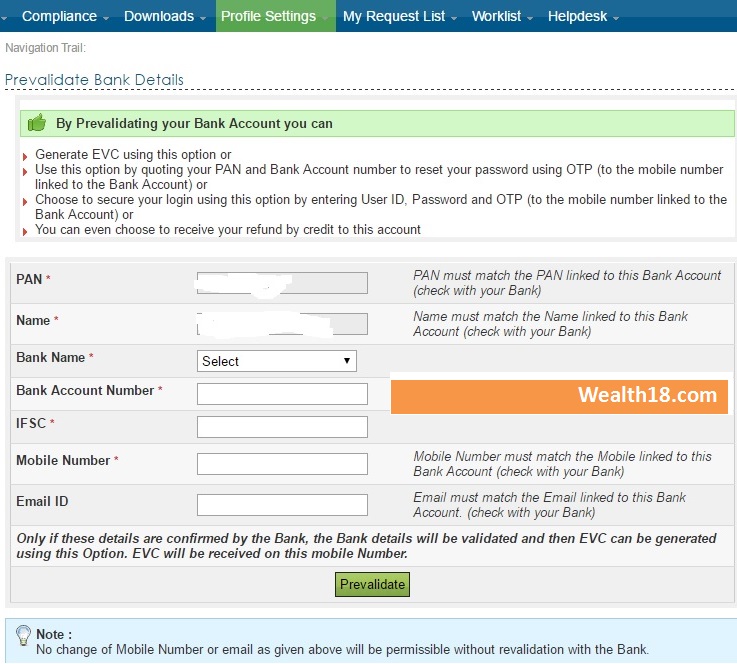

Step 2: Enter details in “Prevalidation” Screen

Once the details are conformed by bank, you can use this option to generate EVC. The EVC will be sent on your registered mobile number.

You can validate your eITR by generating EVC using various mechanisms like Aadhar Card, Netbanking, ATM etc. Read more details about how to use these methods to generate EVC. These measures are used to validate the e-ITR so that the taxpayer does not take the trouble of sending the paper-based ITR-V by post to the Bengaluru based Central Processing Centre (CPC) for final resolution and processing.

The new ITRs have been notified recently. Read more details on which ITR form is right for you.