Lemon Tree Hotels (LTH) is India’s largest chain in the mid-priced hotels sector and third largest overall, on the basis of controlling interest in owned and leased rooms.

Issue Details of Lemon Tree Hotels IPO:

- IPO Open: 26th Mar – 28th March 2018

- Issue Price band: Rs 54 – Rs 56

- Issue Size: Rs 1000 crore

- Market lot: shares

- Minimum Investment: 265 shares (Rs 56 bper share)

- Max Investment for Retail Investor – 3445 shares

- Book Running Lead Managers: CLSA

- Registrar: Karvy

- Listing: BSE/NSE

- Download – Lemon Tree Hotels Red Herring Prospectus

Lemon Tree Hotel IPO Grey market Premium :

- 24th March 2018 – GMP Rs XX per equity share

IPO Issue Allocation:

- Qualified institutional buyers (QIBs) – 50% of the offer.

- Non-institutional bidders – 15% of the offer.

- Retail individual bidders – 35% of the offer.

Background:

Lemon Tree Hotels is India’s largest hotel chain in the mid-priced hotel sector, and the third largest overall, on the basis of controlling interest in owned and leased rooms, as of June 30, 2017, according to the Horwath Report. The hotel chain is the ninth largest hotel chain in India in terms of owned, leased and managed rooms, as of June 30, 2017, according to the Horwath Report. The hotel chain operate in the mid-priced hotel sector, consisting of the upper-midscale, midscale and economy hotel segments. The first Lemon Tree Hotel was opened with 49 rooms in May 2004. The company operated 4,697 rooms in 45 hotels (including managed hotels) across 28 cities in India as of January 31, 2018.

The company operates three hotel segments:

‘Lemon Tree Premier’ which is targeted primarily at the upper-midscale hotel segment catering to businessand leisure guests who seek to use hotels at strategic locations and are willing to pay for premium service and hotel properties;

‘Lemon Tree Hotels’ which is targeted primarily at the midscale hotel segment catering to business and leisure guests and offers a comfortable, cost-effective and convenient experience; and

‘Red Fox by Lemon Tree Hotels’ which is targeted primarily at the economy hotel segment.

As of January 31, 2018, the company have a portfolio of 19 owned hotels, three owned hotels located on leased or licensed land, five leased hotels and 18 managed hotels. The hotels are located in major metro regions in India, including the NCR, Bengaluru, Hyderabad and Chennai,

as well as tier I and tier II cities in India such as Pune, Ahmedabad, Chandigarh, Jaipur, Indore and Aurangabad. In the leisure hotel segment, the chain operate a resort and a hotel in Goa, one resort in the backwaters of Alleppey, Kerala and one wildlife resort in Bandhavgarh, Madhya Pradesh

- We plan to increase the number of our owned hotels and hotels built on leased or licensed land from 22 hotels and 2,796 rooms as of January 31, 2018 to 28 hotels and 4,230 rooms,

- We plan to increase the number of our leased hotels from five hotels and 397 rooms, to seven hotels and 572 rooms

- We plan to increase the number of our managed hotels from 18 hotels and 1,504 rooms as of January 31, 2018 to 38 hotels and 2,933 rooms

In the fiscal year 2017, our owned and leased hotels had an average occupancy rate of 76.8% and our owned and leased hotels had an average occupancy rate of 75.3% for the nine months ended December 31, 2017.

Industry Overview:

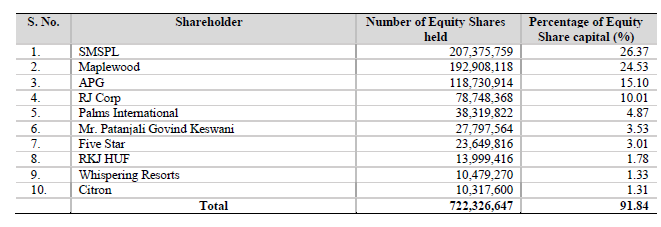

Top Shareholdings: Top Shareholders:

Objective of the issue: The company will not receive any proceeds from the Offer. The objects of the Offer are to achieve the benefits of listing the Equity Shares on the Stock Exchanges and to carry out the sale of Offered Shares by the Promoter Selling Shareholders.

Anchor Investors:

Lemon Tree Hotel receives Rs 311 crores from Anchor Investors.The hotel chain company has finalised allocation of 55,643,820 equity shares to 16 anchor investors which include SBI MF, NS Partners Trust, Mirae Asset Management, Vantagetrust, Indus India Fund, RBC, DB International, Gemequity, Doric, New York State Common Retirement Fund, Zaaba Alpine, HDFC MF and BNP Paribas.

The entire issue consists of offer for sale by Maplewood Investment, RJ Corp, Ravi Kant Jaipuria and Sons (HUF), Whispering Resorts, Swift Builders, Five Star Hospitality Investment Limited, Palms International Investments Limited, Satish Chander Kohli and Raj Pal Gandhi.

Financials:

| Projected | 9 months | In Rs Crores | |||||

| Mar-18 | Dec-17 | Mar-17 | Mar-16 | Mar-15 | Mar-14 | Mar-13 | |

| Revenue | 470.4 | 352.8 | 418.1 | 370 | 291.5 | 223 | 217.4 |

| Growth | 13% | 13% | 27% | 31% | 3% | ||

| Profit / Loss | 2.85 | -7.17 | -29.8 | -63.2 | -39.3 | -19.9 | |

| Non-Current Liabilities | 932.5 | 720 | 547.6 | 497.2 | 469.5 | 383.5 | |

EPS was negative for last 3 years, For 9 months ending Dec 2017, EPS is 0.16. Expected EPS for 2018 will be 0.20. On that basis, at the issue price of Rs 56, the PE ratio will be 280 times.

Valuation as compared to its peers:

| Similar Companies | Revenue | EPS | CMP | Market Cap | PE Ratio |

| The Indian Hotels Company | Rs 4065 crore | (0.64) | |||

| EIH Ltd | Rs 1618 crores | 1.86 |

Brokerage Recommendations:

| Brokerage | Subscribe |

Should you invest:

The company is making losses for the last 5 years. While it has started becoming profitable in 2018, the IPO price is very high. The company is asking Rs 56 on EPS of approx 0.20 which is 280 times. The listed peer (EIH) is trading at 90 times. So the IPO for Lemon Tree Hotels seems expensive.

Also, this issue is Offer for Sale by existing investors, so the company will not be getting funds to repay the debt.

Investors can consider avoiding this IPO. I also do not have any personal interest in investing in this IPO.