Following the sharp depreciation of INR in July – Aug 2013, RBI has taken number of steps to stabilise the currency.

To attract foreign currency, interest rate on FCNR Deposits is increased by 1% for tenure of 3-5 years deposits. Earlier, for FCNR deposits for 3-5 years, Banks could offer LIBOR + 3%, now they can offer LIBOR + 4%

RBI has also allowed banks to increase NRE FD Rates for tenure of 3 years or more. Read my other article – Comparison of NRE FD Rates April 2014

Structured Product for NRIs – FCNR Deposit with Forward Cover / Swap

Many banks are offering a structured product combining FCNR Deposit and Forward Cover and offering a yield of 14%, which is risk free & tax free.

If you have NRE Account with bank, you might have received similar mailer from them.

14% yield… risk free, tax free, sounds exciting…. Let’s understand … should we consider it for investment ……

A. What is this Product?

In simple terms, it is combination of two products –

- FCNR Deposit &

- Forward cover / swap for foreign currency.

B. Products Offerd by different banks

- HDFC – RUPEEMAX – https://www.hdfcbank.com/nri_banking/accounts/fcnr_deposits/rupeemax/ruppemax.htm

- ICICI Rupee Plus Plan – https://www.icicibank.com/nri-banking/bankAccounts/rupee_plus.html#T-1

- SBI – FCNB Premium Account https://www.onlinesbi.com/nri/accounts_deposits/sbinri_ad_dollar_prem_acc.html

- Yes Bank – Premium Rupee Plan – https://www.yesbank.in/branch-banking/global-indian-banking-nri/fixed-deposit/premium-rupee-plan.html

- IndusInd Bank – Rupee Multiplier – https://www.indusind.com/indusind/wcms/en/home/nri-banking/deposit-schemes/rupeemultiplier/

- Axis Bank – NRI Pro Foreign Currency Deposit – https://www.axisbank.com/nri/others/deposits/nri-pro-fcnr-deposit/features-benefits.aspx

- Kotak Bank – Rupee Advantage Plan – https://nri.kotak.com/accounts-deposits/deposits

C. How does it work? What is the Process ?

1) Bank opens an FCNR Deposit in your name (in foreign currency)

To take advantage of higher interest rates allowed by RBI on FCNR deposits, NRI will open an FCNR Deposit in one of the few allowed currencies (USD, GBP, EURO, YEN etc) and it will earn interest on this amount.

The interest rates on FCNR deposits are the same across all banks (as it is regulated by RBI).

Also, Interest on FCNR deposits are tax free in India and are fully repatriable.

2) Forward Cover / Swap to convert the maturity amount in INR

At the time of booking the FCNR, a Forward Agreement is drawn to exchange the maturity amount of the foreign currency in INR at a predetermined exchange rate (Forward Rate). The contract will also have lien on FCNR deposit as the contract is based on FCNR maturity amount.

Documents Required

You just need to submit a form to the Bank (scanned & email) & instruction over email to book FCNR Deposit & forward cover. Later on, you need to send the physical form.

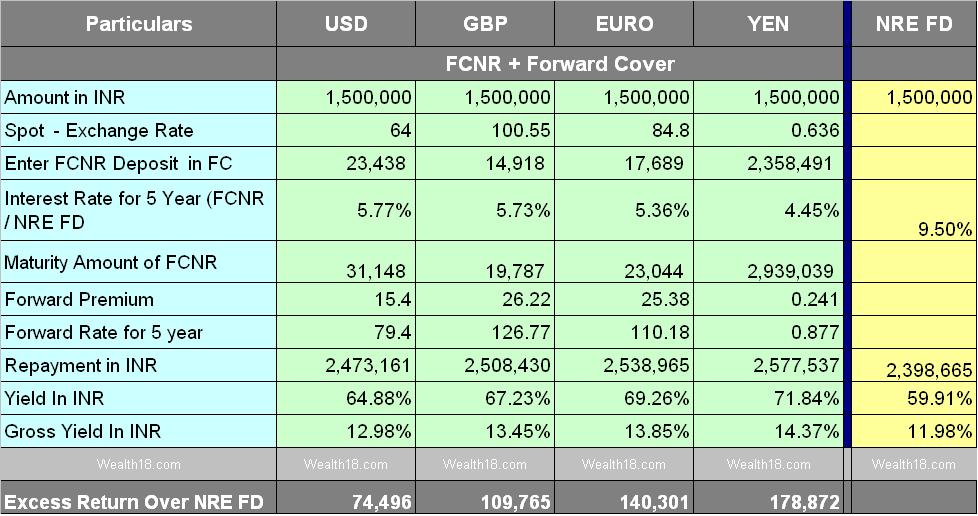

D. Calculation of Yield & Compare with NRE FD Yield

Combination of these 2 products (FCNR + Forward cover), allow banks to offer better returns as compared to NRE FD Yields

Based on data above, note that NRE FD Yiled is coming at 11.98%.

While, if you invest in YEN Based Product (FCNR + Forward cover), you may get yield of more than 14%.

Whether you are sending money in USD,GBP, EURO, or INR (from NRE Account), you can invest in YEN Product. Your original currency will be converted into YEN and then on maturity converted into INR.

E. Benefits

1) No Capital Risk – As amount is invested in FCNR Deposit and exchange rate is pre-agreed, there is no Capital risk.

2) Higher yield than NRE FD – 5 year NRE FD at 9.5% gives a yield of 12% , which this product is giving yield upto 14%

3) Final maturity amount in INR is known – As you are entering the forward cover at same time, you know the final maturity amount credited in INR.

F. Important Points to Note

1) Minimum Investment amount is HIGH. Typically USD 25000 (Approx Rs 16 lakh). – Some relationship managers may say that they need min USD 35000/ USD50000, but if you negotiate & interested in investing, they will do the deal at minimum of Rs 15-16 lakhs.

2) NO Liquidity: The Investment is fixed for 3 / 5 years. You cannot liquidate your position before that. As if you break your FCNR deposit, you will not get interest and breaking Forward cover may also incur charges & loss. So you should invest only if your time horizon is 5 years.

3) Indicative returns: The returns shown by relationship manager are indicative and actual returns will vary a little depending on the time deal is done. However, it should not be varied much. As of now, Deposit in Yen is giving good returns. You can send the form to your banker & instruct to complete the deal when the yield is more than 14.20%.

4) Product is beneficial only if you want to keep money in INR after maturity. If you intend to repatriate the money back in foreign currency, then you are taking the exchange rate risk and higher rate at that time may wipe out your gains.

5) Opportunity Loss in case the INR depreciates further – As you have forward contract to convert your foreign amount at maturity into INR at pre-defined rate, there may be an opportunity loss if the INR rate after 5 year is further depreciated than agreed amount.

For e.g. if 5 yr USD forward is at 79, your USD FCNR will be converted at this rate after 5 years. However, If after 5 years, actual USD Rate is say Rs 90, then you cannot use the opportunity of converting your USD at Rs 90 (spot rate at that time).

G. Taxability

While discussing with multiple bank relationship managers, I was informed that the whole amount is fully repatriable & tax free in India. Even in their emails, they have confirmed that the maturity amount is tax free.

While I understand that Interest earned on FCNR Accounts are Tax free in India. But, the taxability of gain / loss arising from the forward contract is not very clear.

But, Banks are offering this as a Single product combining these two products (FCNR + Forward cover) and giving explanation that both FCNR & NRE Accounts are tax free so income from such product is tax free in India.

Interestingly, all the banks are saying that taxation is not an issue and such proceeds are tax free.

Some of the banks have even posted on their website that such interest is tax free. e.g. Axis Bank, Yes Bank, ICICI Bank. See the bank’s website links

This is one aspect which you should confirm again with your relationship manager.

H. Taxability of this Income in Foreign Countries e.g. NRIs living in USA

For purpose of Global reporting & paying tax in foreign country, you should treat this income similar to what you treat interest on NRE FD.

In countries like US, you need to report your globle income & pay tax as well. Therefore, If you are NRI living in USA, similar to the Interest from NRE FD, any income from this product needs to be reported in annual retursn & pay tax accordingly.

NRIs living in other countries need to treat this income similar to what they treat for NRE FD Interest.

I. Charges

There are no charges for

- opening FCNR Deposit

- for forward cover as the charges are factored in Forward rate

However, when you convert your INR amount lying in NRE Account to Foreign currency for purpose of booking FCNR, service tax is levied by government. On conversion of Rs 16 lakhs, service tax is approx Rs 800.

J. Summary

- Better returns (yield upto 14%) as compared to NRE FD (yield upto 12%)

- This product is for NRIs who can invest large sum (Rs 15 -20 lakhs) for 5 years

- Confirm the tax aspect again from your relationship manager

Disclaimer – I have personally invested in this product (Yen Forward) when the yield was approx 15%.

If you are analysing this product for investment, or invested in this recently, please share your views. (by using comments box below).