Chemplast Sanmar IPO IPO is opening on 10th Aug 2021. Chennai-based Chemplast Sanmar is a leading specialty chemicals manufacturer with focus on specialty paste PVC (polyvinyl chloride) resin and custom manufacturing of starting materials and intermediates for pharmaceutical, agro-chemical, and fine chemicals sectors.

Issue Details of Chemplast Sanmar IPO:

| IPO Opens on | 10 Aug 2021 |

| IPO Closes on | 12 Aug 2021 |

| Issue Price band | Rs 530 – Rs 541 |

| Any Discount | NA |

| Issue Size | Rs 3930 crore |

| Minimum Investment | 27 shares lot (min amount 14607) |

| Max Investment (Retail) | 13 lots / 351 shares (amount Rs 189891) |

| Registrar | KFin Tech |

| Book Running Lead Managers | ICICI Sec, Axis Cap |

| Listing | BSE/NSE |

| Download | Red Herring Prospectus |

Some of the recently listed IPOs have given 100-300% returns in 2021. Also check the list of upcoming IPOs in 2021.

Note: It is not the first time that Chemplast Sanmar is raising money from the primary market. It was delisted nearly a decade ago from stock exchanges in June 2012.

Chemplast Sanmar IPO Grey market Premium :

- As per market observers, Chemplast Sanmar IPO grey market premium (GMP) is at around ₹25-35 (5-6% premium)

IPO Issue Allocation:

- QIB = Not More than 50% of the offer

- NII = Not less than 15% of the offer

- Retail = Not less than 35% of the offer

Background:

In addition, it is also the third largest manufacturer of caustic soda and the largest manufacturer of hydrogen peroxide in the South India region, on the basis of installed production capacity as of December 2020 and one of the oldest manufacturers in the chloromethanes market in India.

After the acquisition of CCVL, it acquired 100 percent equity interest in CCVL that is the second largest manufacturer of suspension PVC resin in India and the largest manufacturer in the South India region, on the basis of installed production capacity as of December 2020.

It has four manufacturing facilities, of which three are located in Tamil Nadu (Mettur, Berigai, and Cuddalore facilities) and one is located in Puducherry (Karaikal facility).

It is a part of the SHL Chemicals Group, which in turn is a constituent of the Sanmar Group. Fairfax India Holdings Corporation, a well-known international investor led by Prem Watsa, based in Canada, has invested, through FIH Mauritius Investments, in the SHL Chemicals Group since 2016.

Top Shareholdings:

Promoter Sanmar Holdings holds 98.81 percent stake in the company and the rest is held by Sanmar Engineering Services (promoter group. It is 100 percent owned promoter and promoter group.

Objective of the issue:

The IPO comprises a fresh issue of Rs 1,300 crore by the company, and an offer for sale of Rs 2,463.4 crore by promoters, Sanmar Holdings and Sanmar Engineering Services.

The net proceeds from the fresh issue will be utilised for early redemption of non-convertible debentures (Rs 1,238.25 crore), besides general corporate purposes.

Anchor Investors:

The company garnered Rs 1,732.5 crore from anchor investors

- Marquee investors which participated in the anchor book were Abu Dhabi Investment Authority, Amundi Funds, Government Pension Fund Global, Best Investment, Corporation, Jupiter India Fund, Neptune Investment, Volrado Venture, Kuber India Fund, CLSA, Public Sector Pension Investment Board, Segantii India Mauritius, Copthall Mauritius, Moon Capital, Goldman Sachs, Tara Emerging Asia, Nomura, and Societe Generale.

- Domestic investors including SBI Mutual Fund, Axis Mutual Fund, Mirae Asset, ICICI Prudential, HDFC Life Insurance, HDFC Trustee, Nippon Life, Franklin India, Aditya Birla Sun Life, Sundaram Mutual Fund, IDFC, JM Financial, IIFL Special Opportunities Fund, and Edelweiss also invested in the company.

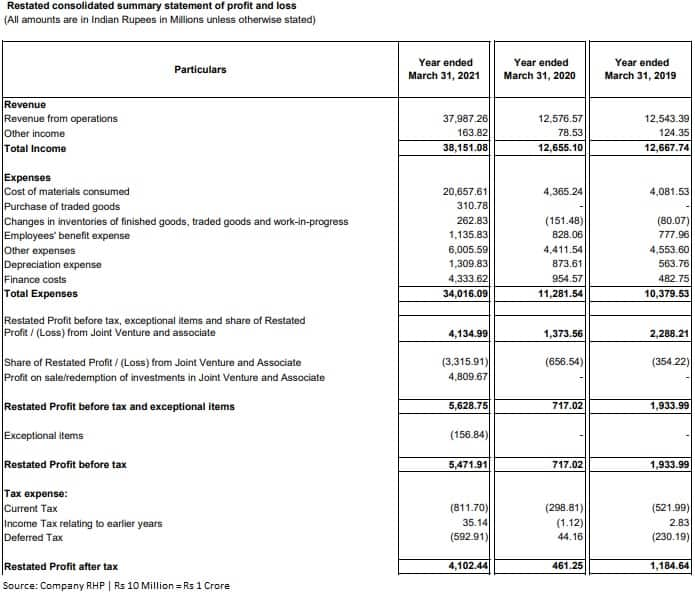

Financials:

- The net worth of Chemplast Sanmar turned negative in the fiscal 2021, not based on operational or cash losses, but due to restructuring, primarily in Chemplast Cuddalore Vinyls Limited (CCVL)

- The outstanding non-convertible debentures (NCDs) of ₹12.4 bn were raised in December 2019 at 17.5% interest per annum directed towards investing in Sanmar Group International-SGIL ( ₹4.8 bn) and repayment of advances received from its promoter Sanmar Holdings limited (SHL) ( ₹6.7 bn), with the remaining amount directed towards servicing its debt.

- The company has redeemed its investments from SGIL in the year 2021 and another ₹9.8 bn investment in a joint venture (JV) with a group entity.

Valuation as compared to its peers:

Pros

- It has leadership position in an industry with high barriers to entry

- It has strong parentage (a part of the SHL Chemicals Group) and strong management team with extensive experience in the chemicals industry and a track record of operational excellence.

- The company is committed to prudent balance sheet management and maximizing free cash flow through continued disciplined approach to financial management

Cons

Brokerage Recommendations:

| Brokerage | Recommendations |

| Subscribe | |

| Subscribe | |

| Subscribe | |

| Subscribe |

Should you invest:

Some of the recently listed IPOs have given 100-300% returns in 2021. Also check the list of upcoming IPOs in 2021.

Disclaimer: This is not an investment advice and is only for educational purposes. Please consult your financial advisor before taking any financial decisions.

Important Dates:- IPO Schedule (Tentative)

| Finalization of Basis of Allotment | Aug 18 |

| Initiation of Refunds | Aug 20 |

| Credit of Equity Shares: | Aug 23 |

| Listing Date: | Aug 24 |

Subscription Details: (Will be Updated)

| (Subscription-Category-Wise (no. of times) Till time : 06:00 PM) | Shares Offered | Day-1 | Day-2 | Day-3 |

|---|---|---|---|---|

| QIB | 0 | 0.02 | ||

| NII | 0.03 | 0.06 | ||

| Retail | 0.83 | 1.29 | ||

| Employee | ||||

| TOTAL | 0.16 | 0.26 |

How to apply for IPO through Zerodha

Zerodha customers can apply online using UPI as a payment gateway. Zerodha customers can apply in CarTrade Tech IPO by login into Zerodha Console (back office) and submitting an IPO application form.

- Visit the Zerodha website and login to Console.

- Go to Portfolio and click the IPOs link.

- Go to the ‘Devyani International IPO’ row and click the ‘Bid’ button.

- Enter your UPI ID, Quantity, and Price.

- ‘Submit’ IPO application form.

- Visit the UPI App (net banking or BHIM) to approve the mandate.

Disclaimer: This article is for educational purposes and should not be treated as investment advice. Please consult with your investment advisor before making any investment decisions.