Aptus Value Housing Finance IPO is opening on 10th Aug 2021. Aptus Value Housing Finance India Ltd is a Home Loan Company. Aptus has been formed to primarily address the housing finance needs of self employed, belonging to Low and Middle Income Families primarily from semi urban and rural markets.

Issue Details of Aptus Value Housing Finance Tech IPO:

| IPO Opens on | 10 Aug 2021 |

| IPO Closes on | 12 Aug 2021 |

| Issue Price band | Rs 346 – Rs 353 |

| Any Discount | NA |

| Issue Size | Rs 2790 crore |

| Minimum Investment | 42 shares lot (min amount 14826) |

| Max Investment (Retail) | 13 lots / 546 shares (amount Rs 192738) |

| Registrar | KFin Tech |

| Book Running Lead Managers | ICICI Sec, Citigroup |

| Listing | BSE/NSE |

| Download | Red Herring Prospectus |

Some of the recently listed IPOs have given 100-300% returns in 2021. Also check the list of upcoming IPOs in 2021.

Aptus Value Housing Finance IPO Grey market Premium :

- As per market observers, Aptus Value Housing Finance IPO grey market premium (GMP) is at around Rs 25-50.

IPO Issue Allocation:

- QIB = Not More than 50% of the offer

- NII = Not less than 15% of the offer

- Retail = Not less than 35% of the offer

Background:

Aptus Value Housing Finance is an entirely retail focussed housing finance company, primarily serving low and middle income self-employed customers in the rural and semi-urban markets of India. It is one of the largest housing finance companies in south India in terms of assets under management (AUM), as of March 2021.

As on March 2021, the company had a network of 190 branches catering to customers across Tamil Nadu, Puducherry, Andhra Pradesh, Karnataka, and Telangana. After successfully growing its presence outside its home state, Tamil Nadu, to other major markets in southern India, Aptus Value Housing Finance is now intending to expand its branch network in large housing markets in Maharashtra, Odisha and Chhattisgarh.

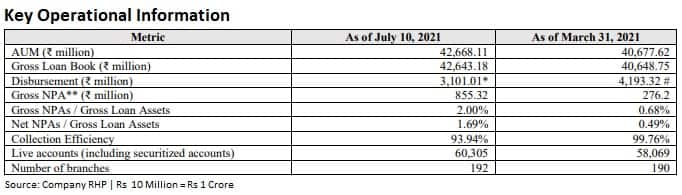

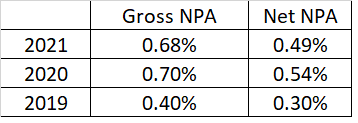

Since the inception of the company, it has not restructured any loans or written-off any loans receivable and as of March 2021, its gross non-performing assets (NPAs) as a percentage of gross loan assets was 0.68 percent.

The company does not provide any loans to builders or for commercial real estate. It does not provide any loans with a ticket size above Rs 25 lakh and the average ticket size of home loans, loans against property and business loans on the basis of disbursement amounts was Rs 7.2 lakh, Rs 7.1 lakh and Rs 6.2 lakh, as of March 2021, respectively. Its home loans, loans against property and business loans had an average loan-to-value of 38.89 percent, 38.27 percent and 39.21 percent, respectively, at the time of sanctioning of the loans.

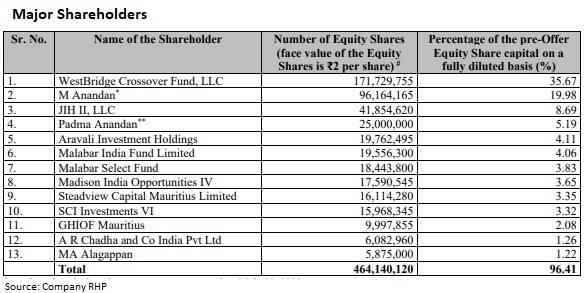

Top Shareholdings:

Aptus Value Housing Finance has a strong capital sponsorship by marquee investors like Westbridge, Malabar Investments, Sequoia Capital, Steadview Capital and Madison India.

Objective of the issue:

Anchor Investors:

Aptus Value Housing Finance has raised Rs 834 crore from anchor investors – Nomura, Copthall Mauritius Investment, Steadview Capital Mauritius, Elara India Opportunities Fund,Edelweiss Mutual Fund (MF) Axis MF and DSP MF.

Financials:

Since the inception of the company in 2010 till date, the company has pristine asset quality with very low NPAs (non performing assets). The firm’s asset under management has grown at a compound annual growth rate (CAGR) of 34.54% to Rs 4,068 crore during FY19-FY21.

Loans to self-employed customers accounted for 72% of the assets under management as of March 2021, while the balance 28% accounted for salaried individuals.

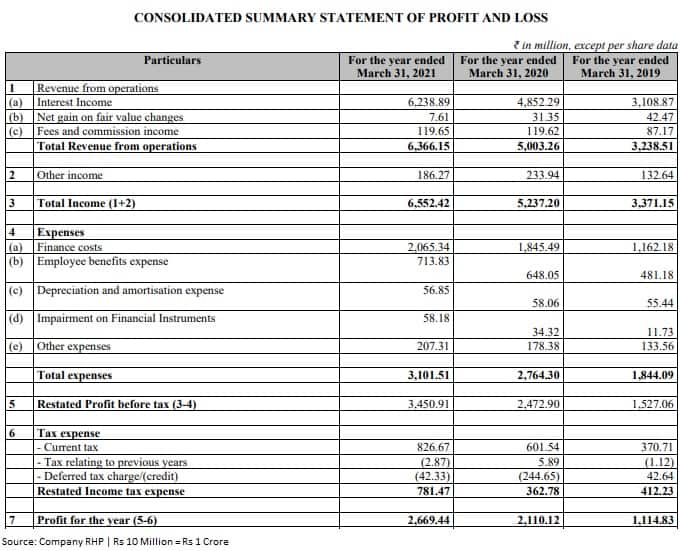

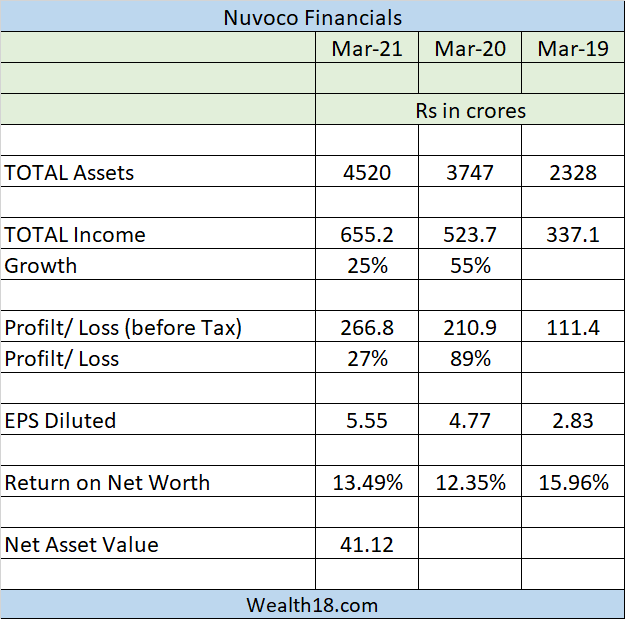

Aptus Value reported consistent growth in financials in last three fiscals. Profit in the year ended March 2021 stood at Rs 266.94 crore on revenue of Rs 636.6 crore, against profit of Rs 211 crore on revenue of Rs 500.3 crore in FY20, and profit of Rs 111.48 crore on revenue of Rs 310.88 crore in FY19.

Its focus on serving self-employed customers has resulted in high yields for its loan portfolio. As of March 2021, its average yield on disbursements was 16.88% against 17.18% in FY20 and 17.23% in FY19. It had the lowest cost to income ratio among the peer set during the financial year 2021, with operating expenses to net income ratio at 21.80 percent and credit costs to average total assets at 0.14 percent.

Its stronger yields and cost control measures have enabled it to achieve a superior return on assets of 6.46 percent in FY21. It had the highest return on assets of 5.7 percent among the peer set during the financial year 2021.

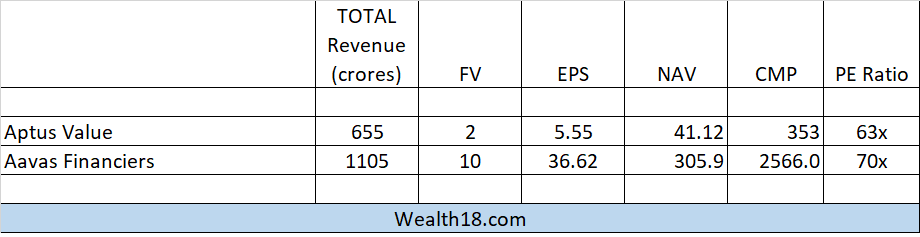

Valuation as compared to its peers:

On a post-issue basis, the IPO is valued at 7.1 times the book value of Rs 50.10, while suggesting the issue is aggressively priced. Its peer Home First Finance trades at a trailing P/BV of 3.6 times. While Aavas Financier trades at P/BV of 8.1 times, its asset under management (AUM) is more than double of Aptus’.

Pros

- presence in large, underpenetrated markets with strong growth potential

- robust risk management architecture from origination to collections leading to superior asset quality.

- established track record of financial performance with industry leading profitability

Cons

- 52% of Aptus Value’s loan portfolio comes from Tamil Nadu and past experiences of Repco and Can Fin Home suggest that slowdown in home states impact growth as well as profitability for regional HFCs.

- there is a limited track record of Aptus’ assets as housing finance loans behavioral maturity is 7-8 years, whereas 65 per cent of the company’s book is built over the past three years.

- Aptus operates at a leverage of 2 times as opposed to a sector average of 6-8 times, and this over capitalisation may lead to a low teen return on equity (ROE) despite strong profitability.

Brokerage Recommendations:

| Brokerage | Recommendations |

| Choice Broking | Subscribe |

| Marwadi Shares | Subscribe |

| Subscribe | |

| Subscribe |

Should you invest:

The company has strong presence in underpenetrated markets and strong risk management. The revenue and profile has seen robust growth over last 3 years. But the company is asking 5.4 times book value which is fully pricing the growth.

Some of the recently listed IPOs have given 100-300% returns in 2021. Also check the list of upcoming IPOs in 2021.

Disclaimer: This is not an investment advice and is only for educational purposes. Please consult your financial advisor before taking any financial decisions.

Important Dates:- IPO Schedule (Tentative)

| Finalization of Basis of Allotment | Aug 18 |

| Initiation of Refunds | Aug 20 |

| Credit of Equity Shares: | Aug 23 |

| Listing Date: | Aug 24 |

Subscription Details: (Will be Updated)

| (Subscription-Category-Wise (no. of times) Till time : 06:00 PM) | Shares Offered | Day-1 | Day-2 | Day-3 |

|---|---|---|---|---|

| QIB | 0.25 | 0.33 | ||

| NII | 0.01 | 0.06 | ||

| Retail | 0.32 | 0.54 | ||

| Employee | ||||

| TOTAL | 0.24 | 0.37 |

How to apply for IPO through Zerodha

Zerodha customers can apply online using UPI as a payment gateway. Zerodha customers can apply in CarTrade Tech IPO by login into Zerodha Console (back office) and submitting an IPO application form.

- Visit the Zerodha website and login to Console.

- Go to Portfolio and click the IPOs link.

- Go to the ‘Devyani International IPO’ row and click the ‘Bid’ button.

- Enter your UPI ID, Quantity, and Price.

- ‘Submit’ IPO application form.

- Visit the UPI App (net banking or BHIM) to approve the mandate.

Disclaimer: This article is for educational purposes and should not be treated as investment advice. Please consult with your investment advisor before making any investment decisions.