Shriram Transport Finance Company (STFC) has come out with public issue of secured non convertible debentures (NCDs) of face value of Rs 1,000 each, aggregating to a total of up to Rs 750 crore with yield upto 11.15%

About the Company

STFC is Flagship Company of “SHRIRAM” group which has significant presence in financial services & non-financial services business.

STFC was incorporated in the year 1979 and is registered as a Deposit taking NBFC with Reserve Bank of India under section 45IA of the Reserve Bank of India Act ,1934.

Shriram Transport Finance Company’s primary focus is on financing pre-owned commercial vehicles. In addition, the company also provides finance for new commercial vehicles, passenger commercial vehicles, multi-utility vehicles, three wheelers and tractors. In addition, it provides ancillary equipment and vehicle parts finance, such as loans for tyres and engine replacements, and provides working capital facility for FTUs and SRTOs.

- Largest Asset Finance NBFC in India

- STFC is leading non-banking financial company with Revenues of Rs 6558 crore & Net Profit of Rs 1360 crores (31-Mar-2031)

- FII hold 49.45% of STFC as on Mar 2013

- Long term debt / Equity Ratio = 2.65

- Total debt/equity – 3.22

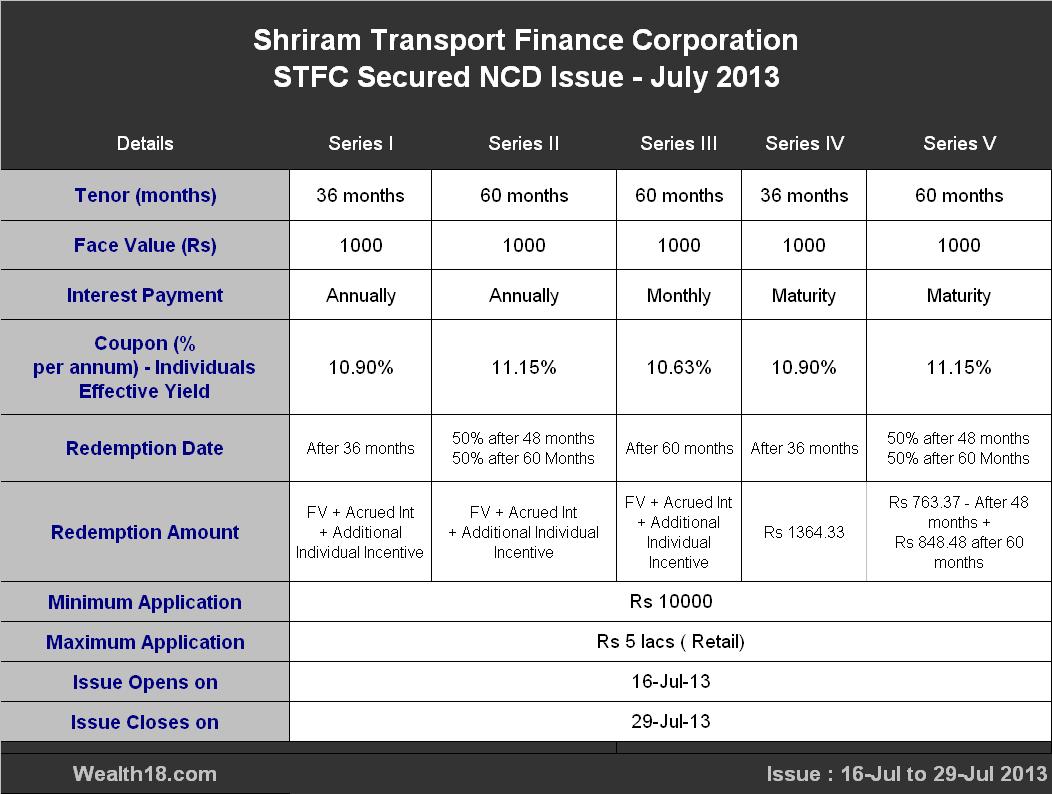

Important Dates for STFC Secured NCD Issue – July 2013

- Issue Opens on 16-Jul-2013

- Issue Closes on 29-Jul – 2013

Interest Rates for Retail Individual Investors

- Series 1 annual coupon is 10.90 %

- Series 2 annual coupon is 11.15 %

- Series 3 annual coupon is 10.63 %

- Series 4 effective yield is 10.90 %.

- Series 5 effective yield is 11.15 %

Other Important Points

- Minimum application for subscription in retail segment is of Rs 10,000

- Max investment for Retail investors – Rs 5 lakh

- Investors can choose to apply in demat as well as physical form.

- The allotment will be made on a “first-come-first-served” basis.

- NRI Investment: NRI’s cannot invest in this NCD Issue

Taxation

- The interest earned on these NCD is taxable

- In case of Monthly / Annual Interest Payment option – the same is taxable under Income from Other Sources

- In case you sell the NCD on stock exchange, the income will be treated as Capital Gain.

- Any Short term capital gain is taxed at normal rates. Any Long term Capital gain (after 12 months) will be taxed at concessional rate of 10.3%

- If NCD is purchased in DMAT Form, no TDS is deducted on the Interest.

- If NCD is purchased in Physical form, TDS will be deducted if interest exceeds Rs 5000

Why invest:

- The issue is rated AA/stable by CRISIL & AA+ by CARE.

- STFC is a leading non-banking financial company with Revenues of Rs 6500 crore & Net Profit of Rs 1360 crores

- As these bonds are listed on BSE/NSE, you can sell them in secondary market. If the interest rates in market go down, NCD prices will go up & you can earn extra return.

Why not to invest:

- Company’s Long term Debt / Equity ratio is 2.65 – which is highly leveraged.

- As compared to Short term debt funds, these NCDs are less liquid.

- Additional Interest payable to Individuals will be paid only at the time of Maturity (which means you need to hold it till maturity

Download the Application Form & Prospectus

You can download the Form here – from STFC Website.

https://www.stfc.in/pdf/news/STFC-NCD-Issue_July-05-2013_Prospectus-PDF.rar

How to Invest

If you have DMAT Account, then you can apply through your broker, For e.g Go to your online trading account & there will be an option to apply for these NCD.

Alternatively, you can download the application form and submit alongwith the cheque at Lead Manager, co-manager, broker office.

Summary

Invest only if you want to remain invested till maturity.

If you are in higher Tax slab & donot need annual Income , you should buy Series IV / Series V.

If you sell them after 1 year, the Income will be treated as Long term Capital gain (after 12 months) and will be taxed at concessional rate of 10.3%

Read my other Post – What is NCD & Should you Invest in NCDs ?