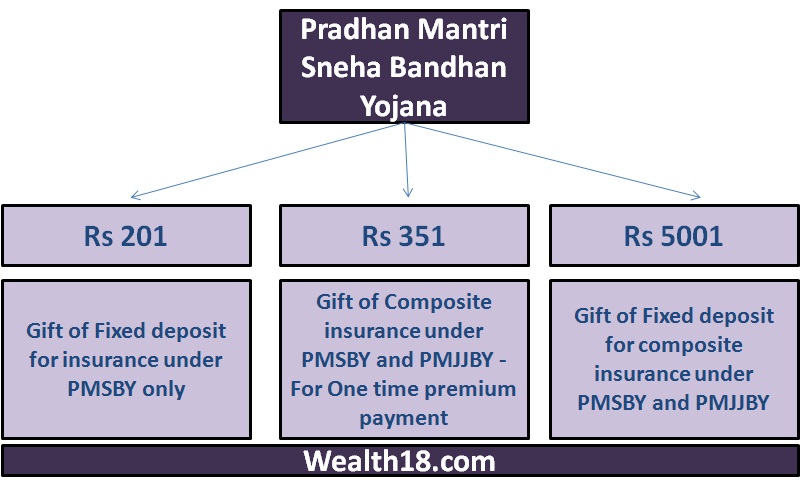

Modi Government has announced one more yojana – Pradhan Mantri Sneha Bandhan Yojana on the occasion of of Raksha Bandhan. Three specially designed gifts products are announced under the umbrella of “Pradhan Mantri Sneha Bandhan Yojana” and will be available from 1st August, 2015 in all the designated banks.

What is Pradhan Mantri Sneha Bandhan Yojana?

Pradhan Mantri Sneha Bandhan Yojana is an Insurance Linked Fixed Deposit Scheme which will reap interest at the prevailing rate. It comes in a form of Gift Card or Banker’s Cheque which you can buy from the designated banks and give it to your loved ones. The receiver can either visit to his/her existing bank account or open a new zero balance bank account to deposit the Gift Card or Banker’s Cheque.

1. Pradhan Mantri Sneha Bandhan Yojana gift card for Rs.201 (Gift of Fixed deposit for insurance under PMSBY only)

This Gift Card for Rs.201 is to cover insurance premium under Pradhan Mantri Suraksha Bima Yojana only. The amount will be utilized as below:

- Rs 12 will be instantly deducted towards the premium for PMSBY as first year’s premium.

- Rs 12 will be kept separately in a SB account for paying second year’s premium.

- Balance amount of Rs. 177 will be invested in a Fixed / term deposit for ten years at the then prevalent interest rate (8% p.a) for earning annual interest income of Rs. 14.16 which will be sufficient for annual insurance premiums, at the current rate, up to the date of the Term Deposit.

- The term deposit interest will be used for paying insurance premium under PMSBY for future years and for no other purposes.

2. Pradhan Mantri Sneha Bandhan Yojana gift card for Rs.351 (Gift of Composite insurance under PMSBY and PMJJBY – For One time premium payment)

- Rs 342 will be instantly deducted towards the premium for PMSBY as first year’s premium.

- Rs 342 will be kept separately in a SB account for paying second year’s premium.

- Balance amount of Rs. 4317 will be invested in a Fixed / term deposit for five or ten years at the then prevalent interest rate (8% p.a) for earning annual interest income of Rs. 345.36 which will be sufficient for annual insurance premiums, at the current rate, up to the date of the Term Deposit.

- The term deposit interest will be used for paying insurance premium under PMSBY for future years and for no other purposes.