Pradhan Mantri Garib Kalyan Yojana (PMGKY) – Undisclosed Income declaration deposit scheme

Government has brought in second income disclosure income called Pradhan Mantri Garib Kalyan Yojana. The new IDS has been notified along with other provisions of the Taxation Laws (Second Amendment) Act, 2016, on 16th December and has come into effect from 17th December, 2016. You can declare your unaccounted income under this scheme from 17th December 2016 to 31st March, 2017.

Key Features of Pradhan Mantri Garib Kalyan Yojana

- People can declare their undisclosed or black money under PMGKY Scheme till 31st March, 2017

- Under this scheme, a declarant of undisclosed income needs to pay a Tax of 30%, a Penalty of 10% and a Pradhan Mantri Garib Kalyan Cess of 33% on the tax, all of which add up to around 50%.

- In addition to the above penalty, the declarant will have to deposit 25% of the undisclosed income in the zero-interest ‘Pradhan Mantri Garib Kalyan Deposit Scheme 2016‘ for four years.

- As per the Govt, this is going to be the last chance to convert your black money in to white money through an IDS Scheme.

- The declarations made under PMGKY scheme will be kept confidential, and those coming clean will not be prosecuted under other legislations such as Central Excise Act, Wealth Tax Act, Companies Act, However, there will be no immunity from prosecution under criminal acts like the Prevention of Corruption Act and Prevention of Money Laundering Act.

- The government has also encouraged people to come forward with information about tax evaders by emailing such information to [email protected].

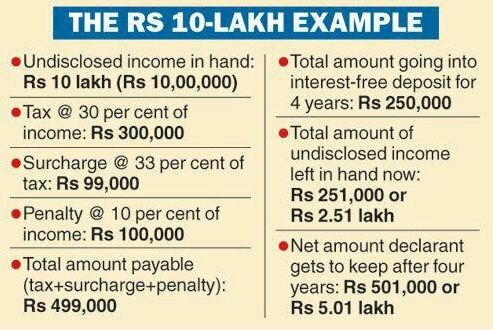

Steps : Let’s assume the person is declaring Rs 10 Lakh as undisclosed income under this scheme.

- Pay Applicable tax – The person has to first pay Tax on the undisclosed income

- The applicable income tax on Rs 10 Lakh is @ 30% = Rs 3 lakhs

- Applicable PMGK Cess @ 33% on tax = Rs 99000

- Applicable penalty is @ 10% on undisclosed income (Rs 10 Lakh) = Rs 1 lakh

- So, the total tax is Rs 499000

- Pay the tab above through online via e-Filing portal or at bank branches through relevant forms

- the person has to put 25% of the declared income i.e., Rs 25,000 in the PMGKY Deposit Scheme. This is locked for four years and no interest income on this deposit is paid to the declarant. The declarant has to take acknowledgment receipt from the bank/post office.

- After paying the applicable taxes & depositing 25% of the declared income, the person has to submit Form-1 through online or offline modes. The declarant has to provide personal details, contact details, PAN, declared income details, tax paid details & PMGKY deposit acknowledgment details in Form 1.

- Online Income Tax Portal – Login to e-filing portal and click on new tab “PMGKY’ and then click on ‘Prepare & submit online Form 1 (PMGKY)

- Enter details as mentioned in form, tax paid, attach documents etc

- After receiving the Form 1, the IT department will issue Form 2 (acknowledging the receipt of form-1 & taxes) to the declarant within 30 days of receiving Form 1