| Day | Subscription (no. of times) |

| Day 1 | 0.06 |

| Day 2 | 0.21 |

| Day 3 | 1.05 |

| Day 4 | 2.34 |

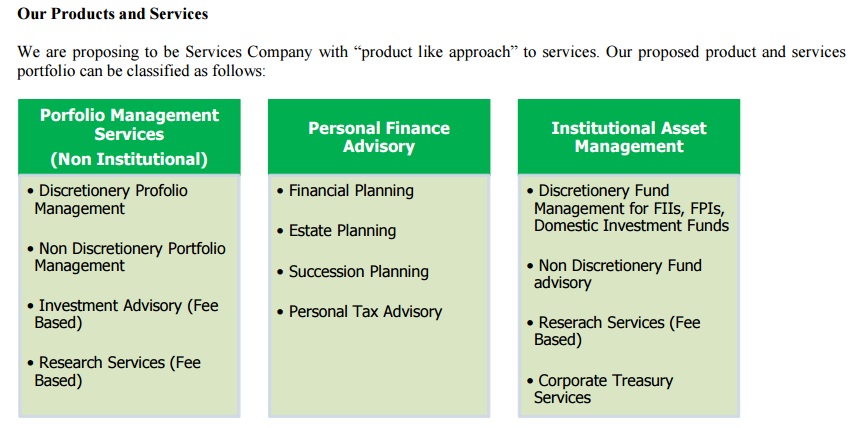

Escorp Asset Management Limited is engaged in providing portfolio management services and/or managing funds. The Company is engaged in business activities, such as investment advisory; corporate treasury advisory; institutional fund management and advisory; research services, and personal tax planning and advisory services.

EAML is a asset management arm of the group that has also applied to SEBI for registration as Portfolio Manager that is under process.

Issue Details of Escorp Asset Management SME IPO

- Issue Open : 31st March to 6th April 2017

- Issue Price / Floor Price : Rs 15 per share

- Issue Size: Rs 3.24 crores (21,60,000 Equity Shares)

- Application per share : Rs 15

- Minimum No of shares bid: 8000 shares / Rs 120,000

- Maximum Retail investment – 8000 shares

- Book Running Lead Managers : BCB Brokerage

- Registrar – Bigshare Services Pvt Ltd

- Listing: NSE SME

Ongoing SME IPO – Read reviews

| SME IPOs | Opening Date | Last Date | Price |

| ASL Industries | 31-Mar-2017 | 7th April 2017 | 35 |

| Dev Information Technology | 31-Mar-2017 | 6th April 2017 | 42 |

| MK Proteins | 31-Mar-2017 | 7th April 2017 | 70 |

| Escorp Asset Management | 31-Mar-2017 | 6th April 2017 | 15 |

| Focus Lighting | 30-Mar-2017 | 5th April 2017 | 45 |

| Creative Peripherals | 29-Mar-2017 | 3rd April 2017 | 21-75 |

About the Company

This is a subsidiary company of Aryaman Financial Services Limited which is the flagship company of the Aryaman Group. Aryaman Group is a Financial Services player having interests in Merchant Banking, Investment Banking, Corporate Advisory, Stock Broking, Market Making and Equity Investments

AFSL; our corporate promoter is actively involved in the business of Merchant Banking and has completed 2 Main Board IPOs, 21 SME IPOs, 18 Open Offers, 1 Delisting Offer, and many other valuation and corporate advisory activities since the change in management in 2007 – 08. AFSL has been a pioneer in the field of SME IPOs having been the first Merchant Banker to complete an SME IPO and list the same on an SME Exchange in India. AFSL has received the award for being one of the “Top Performing” Merchant Bankers in the SME Segment from BSE for three years since beginning of this segment in 2012. The market making and group proprietary investment and trading activity are being carried out through ACML. Both AFSL and ACML are listed on BSE and BSE SME respectively and are having an aggregate market capitalisation of around K 5,000 lakhs.

Financials

| FY 12 (in lakhs | FY 13 (in lakhs) | FY 14 (in lakhs) | FY 15 (in lakhs) | FY 16 (in lakhs) | FY 17 (6 lakhs) | |

| Income | 0.07 | 0.15 | 0 | 0.05 | 0.26 | 9.74 |

| Profit | 0.02 | 0.04 | 0 | 0.01 | 0.16 | 2.99 |

Our net worth and total balance sheet size as on September 30, 2016 was Rs 5.24 crores and Rs 7.94 crores .

The company has no history of business as you can see the revenue is almost nil in last 5 years.

Summary – There is very little information on company’s business model, the revenue & profit for last 5 years is almost NIL. Investors may want to avoid this IPO.