From Jan 2013, Direct Plan for Mutual funds are in the market. In the first month, people were sceptical if there is going to be much difference in returns on Standard Plan & Direct Plans of Mutual Funds.

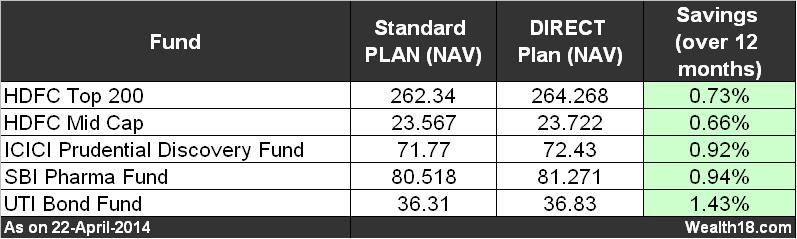

Here is the NAV Comparison of some MF under Standard Plan & DIRECT Plan over last 1 year

So, fromt the table you can see that you can see the Savings made by DIRECT Plan of Funds over last 1 year.

A. What is Direct Plan of Mutual Funds?

From 01-Jan-2013, Investors have the option of investment in the Direct Plan option of mutual funds.

| DIRECT Plan | STANDARD Plan |

| you invest directly with Mutual Fund Company (AMC | you invest through mutual fund agent (individual / bank / online) |

The DIRECT PLAN of mutual fund scheme has lower expense ratio as compare to STANDARD Plan as no agent is involved & some distribution cost / trailing fees are saved.

These distribution cost savings are now passed to Investors by way of DIRECT PLANS.

B. How to Identify – Direct Plan of Mutual Funds

You will see the word “DIRECT” affixed to mutual fund scheme name. For e.g

HDFC Top 200 Growth

HDFC Top 200 Growth – DIRECT

C.How it is different from Standard Plans

Everything is same in Standard Plan & Direct plan except lower expense ratio. All the underlying investments are the same.

The ONLY difference is that DIRECT Plan will have

- LOWER expense ratio than Standard Plan

- HIGHER NAV than Standard Plan

D. How much will be the difference & How it will impact my Returns

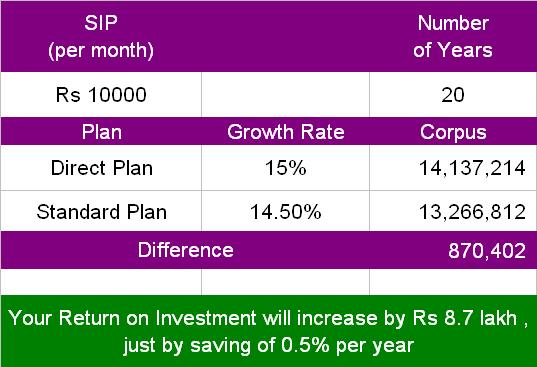

Normally in Equity funds, the commissions are 0.5% – 0.75% per year depending on the schemes.

So under DIRECT Plan, you can save up to 0.50% – 0.75% per year.

The difference of 0.5-0 – 0.75% looks small, but since it is a recurring expense in the long run it can make a reasonable difference.

In case of 0.75% savings, your corpus will be higher by Rs 12.85 lakhs as copared to Standard plan.

E.Who should choose Direct Plan of Mutual Funds :

Sounds exciting that you can save some costs. But THINK & ANALYSE before you go for this option.

The DIRECT PLAN is good for investors who has good understanding of markets & mutual funds and can identify & monitor their portfolio on periodic basis.

Here you donot get any advice or support from your agent and have to do everything on your own.

Ask yourself –

- – Do you understand the various mutual funds options available in market?

- – Do you have time to analyse the schemes

- – Can you analyse your portfolio periodically & make necessary changes

- – Can you manage without expert advice?

If your answer is YES, then go for the DIRECT PLAN.

F. Who should not choose DIRECT PLAN?

If you think, you do need an expert to advice you on your Funds investment, then invest through an MF Advisor.

Just to save 0.50%, do not risk your entire investment. You will be able to compensate this cost, by earning extra returns on your professionally selected funds as compared to wrongly selected funds by your own.

You can use services of a Financial Advisor (not Mutual Fund Agent)

You can take help of a Financial Advisor, who will charge around Rs 10000 per year and advise your good MF schemes to invest in and can review the schemes every year. You can then invest in Direct Plans of MF which are suggested by your Financial Planner.

You will still save considerable amount.

G. How to invest in Direct Plan

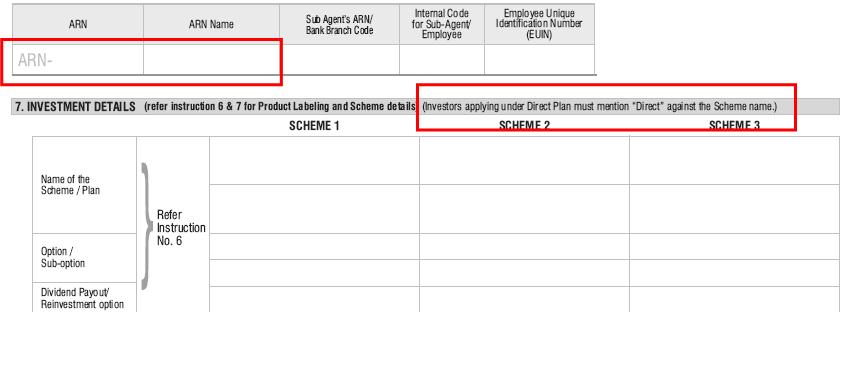

If you want to invest in DIRECT PLAN of Mutual fund, Just make sure that

- – You tick mark word “DIRECT” in Mutual Fund Form

- – Write – ‘ DIRECT’ In ARN column

- – WRITE – DIRECT against Scheme Name – when you write which scheme to invest in

For e.g. in HDFC Mutual Fund Form – Write DIRECT in ARN & against Scheme name

H.How can I change existing funds to Direct Plan?

You need to submit the SWITCH Request from the old Standard Plan to NEW DIRECT PLAN.

I. Will my existing SIP be considered under Direct plan by Default?

1) If you have invested in SIP through agent / distributor, then you need to

- Submit SWITCH for previous investment amount

- Stop the existing SIP

- Start new SIP under DIRECT PLAN

2) If you have invested in SIP direct at AMC (without ARN Code), then

- Your future SIP will automatically be under DIRECT PLAN

- Submit SWITCH for previous investment amount

J. Earlier, I have invested in Mutual fund DIRECTLY with AMC. Is it not the same?

No. If you have invested directly with AMC (before 1-Jan-2013), these will still be under Standard Plan as Cost savings were not passed to Investors.

You need to switch the earlier investments to DIRECT Plan to get the benefit.

K. Impact of shifting to Direct Plan

When you consider switching, please note that it will have impact on your Income Tax as well as Exit Load of Funds.

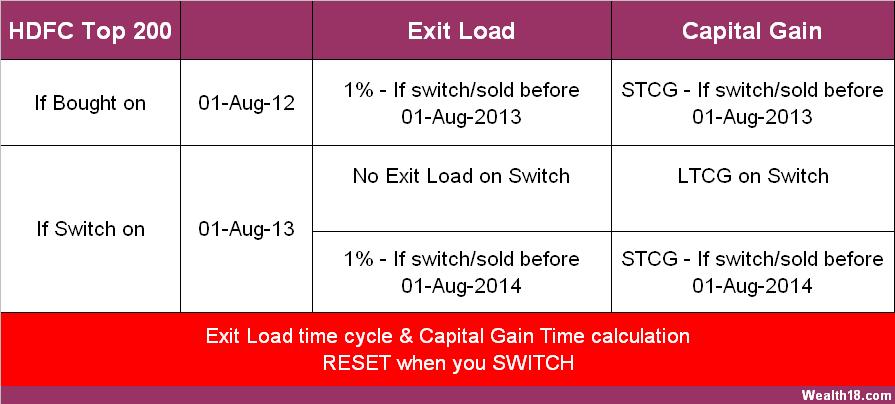

Exit Load

If your current MF investment is through distributor and you want to switch to DIRECT Plan, then exit load might be applicable as per the scheme

If your current MF investment is through AMC Direct, then no exit load will be applicable to switch to DIRECT PLAN

Note that once you switch to DIRECT plan, the exit load period resets.

For e.g if you invest in MF on 01-Jan-2013, and exit load is 1% (if exit before 6 months)

If you switch to Direct plan on 01-Jul, then no exit load applies.

But, then if you sell it before 31-Dec-2013 (6 months from Switch), exit load will apply.

Capital gain

For Income Tax purpose, Switch to different plan will be considered as Sale & then purchase.

So, if you switch before 1 year on investment, it will be treated as Short term capital gain. Also, once you switch, you will have to wait for 1 year to claim Long term capital gain benefit.

For e.g if you invest in MF on 01-Jan-2013, and If you switch to Direct plan on 01-Jul, then it will be treated as STCG.

& If you sell that switched investment before 30-Jun-2013, it will attract STCG (after 01-Jul-2014 – it will be LTCG)

Note that the Exit Load period & Capital Gain period will be RESET when you switch the Plans.

So it is better to SWITCH to DIRECT PLAN, only if you have intention to hold the MF units

– till the end of exit load expiry period (from date of switch) &

– for at least 1 year ( so that Long Term capital gain benefit is received)

L. Summary

– DIRECT Plan is cost effective as compared to Standard Plan.

– Switch to DIRECT Plan if you understand the MF Schemes, can monitor portfolio by yourself.

– Switch to DIRECT Plan only if you intent to hold the units for atleast 1 year to get LTCG tax benefit.

M. Read my other Posts :

Best Performing Mutual Funds to invest in 2014

Mutual Fund – Taxation Aspects

N.Feedback / Queries

Have you switched to Direct Plan? Please share your views. Any queries, please comment below.