When you have invested in other Equity funds, like Large, Midcap, Small cap, Multipcap Equity funds etc, you can consider allocating some funds to any sector specific or Thematic funds.

As the name suggests, these funds invests in share of specific industry (e.g. pharma) or specific theme (i.e. infrastructure) etc.

These funds have higher risk as compared to diversified Equity funds, so you should allocate only a portion of your funds, for e.g. 10-15% depending on your risk profile.

Some of the best performing Sector / Thematic Funds are as follows for investment in 2021

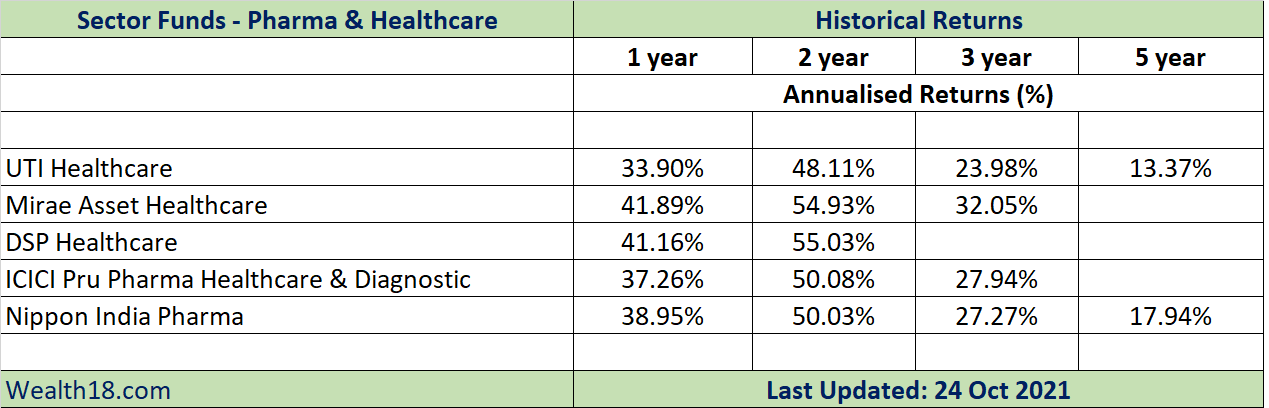

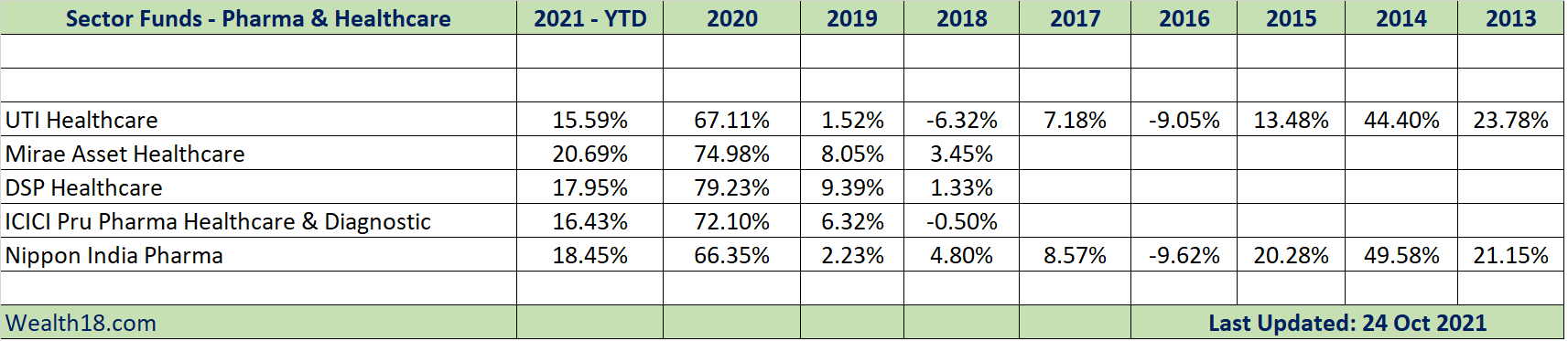

Pharma & HealthCare funds

Due to recent pandemic, Pharma & Healthcare sector companies are doing well and are giving good returns

You may note that Pharma funds have not done well during 2016-2019, but doing well over last 2 years.

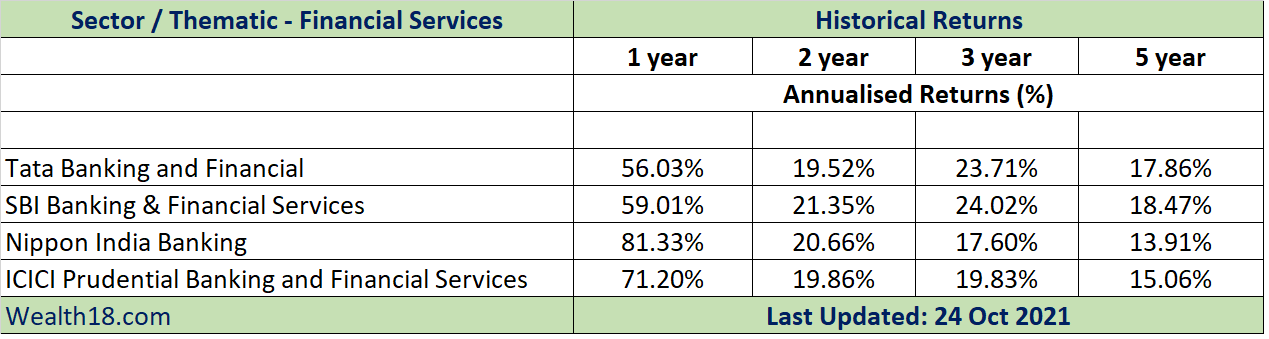

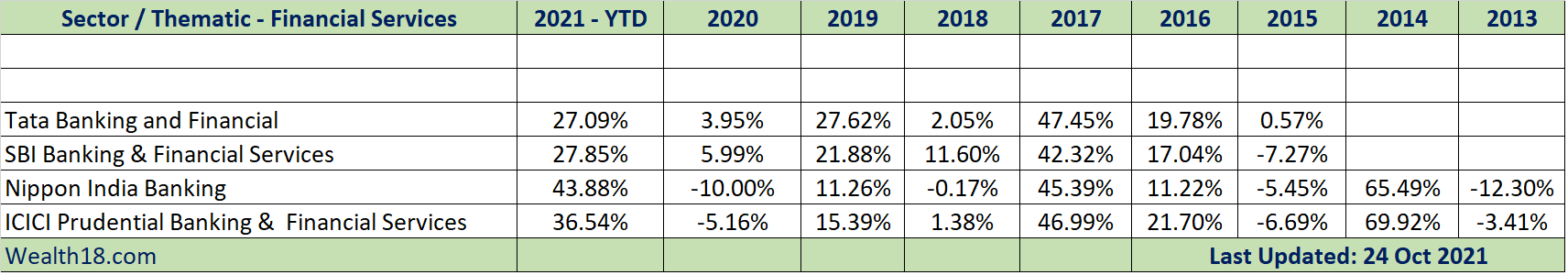

Banking & Financial Services Sector Funds

Due to COVDI-19 situation, banking stocks have taken a big hit. As a result the returns in 2020 YTD has turn negative, thereby impacting the long term average returns.

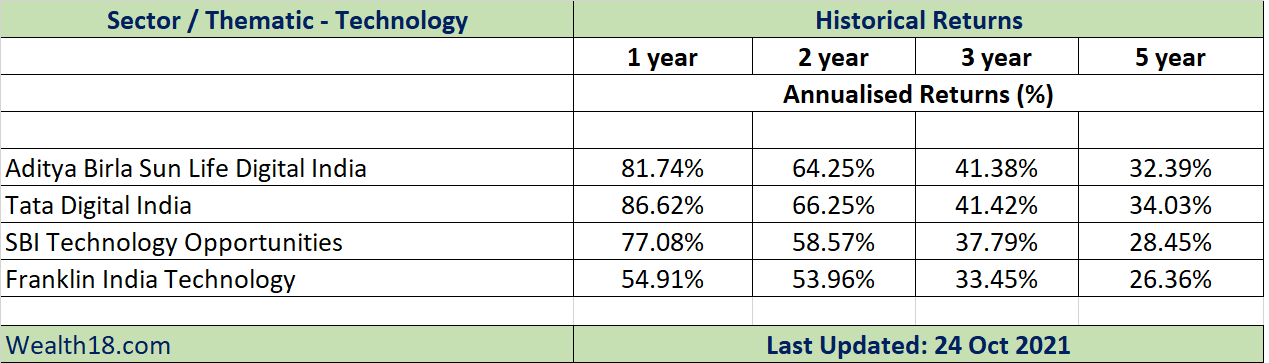

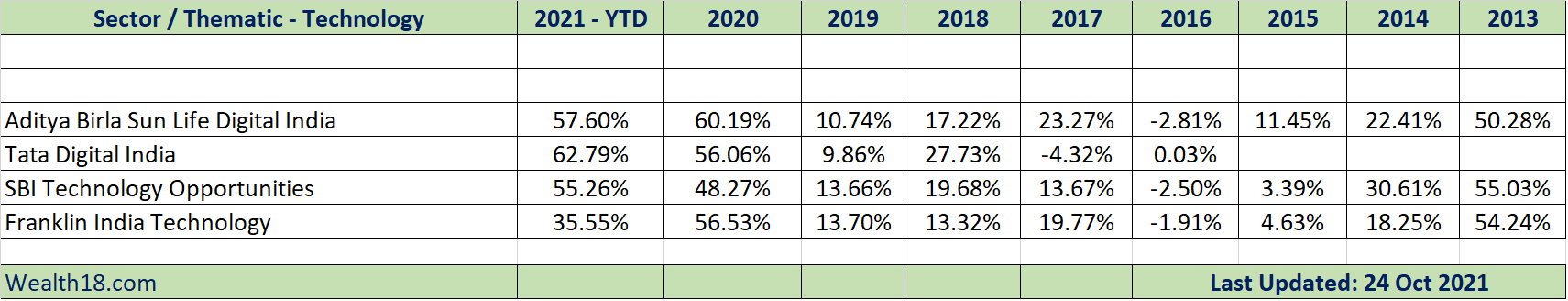

Technology / Digital Funds

The returns from technology funds are quite consistent, so investors can consider these thematic funds.

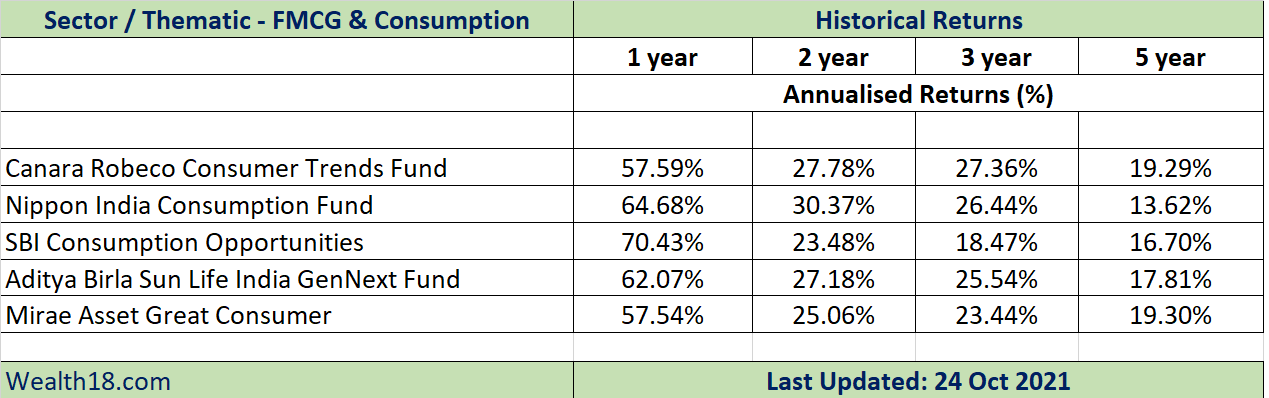

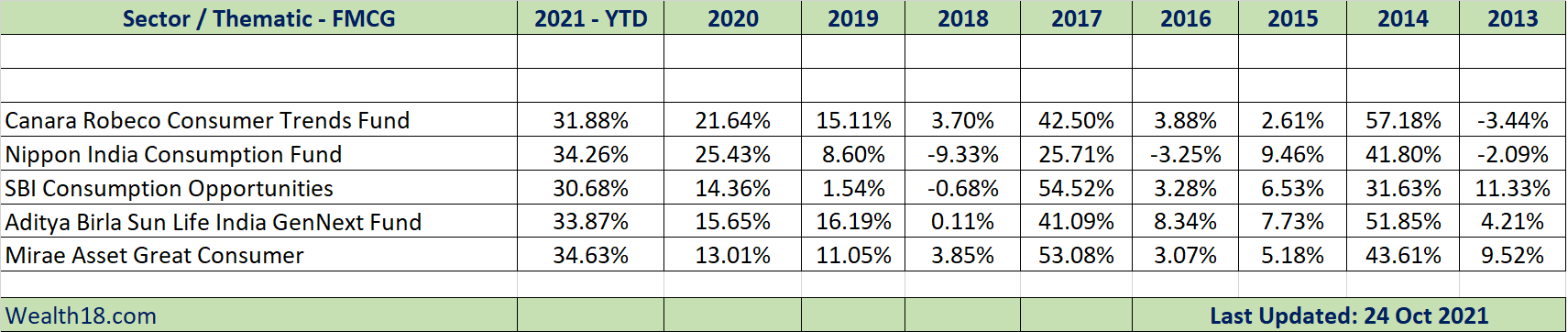

FMCG and Consumption Funds

FMCG and Consumption funds have mostly given positive returns in last 7 years. Though 2020 YTD is an exception, the situation should improve post COVID.

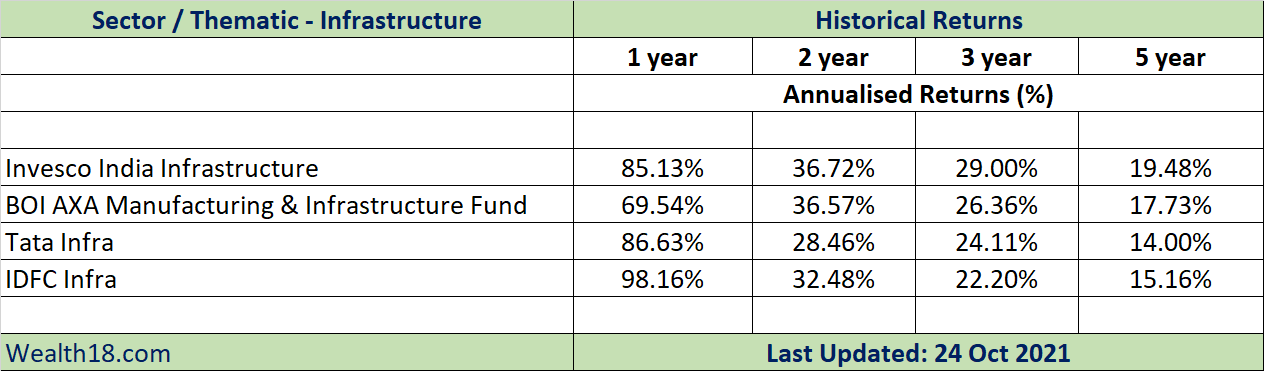

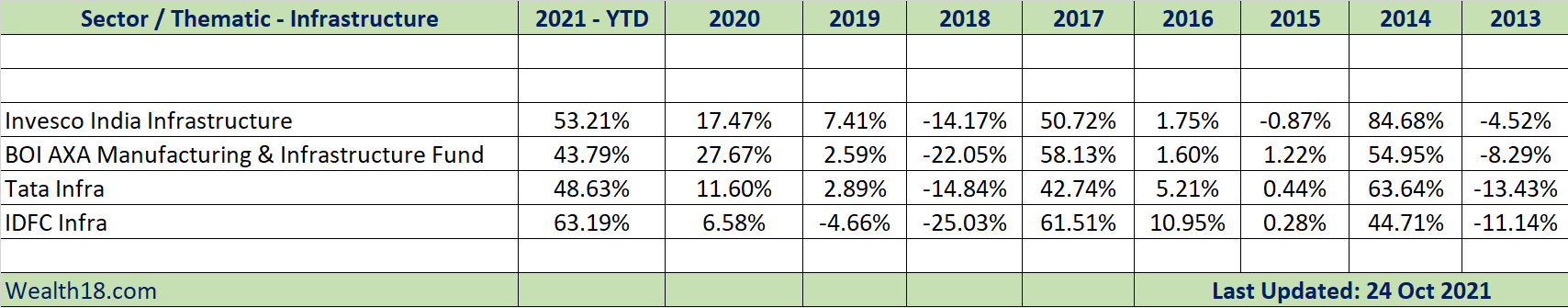

Infrastructure Funds

Please see my other posts on

- Best Performing Equity funds – Large Cap, Midcap, Small Cap, Multicap

- Best Performing ELSS funds (Tax Savings Funds)

- Best Performing International Funds – Invest in Google, Facebook, Amazon, Apple

- Best Performing Sector Funds -Pharma, Banking, Technology, Consumer

- Best Performing Arbitrage funds ( almost risk free and can be used as alternative to Fixed Deposits)

Please comment below if you have any queries related to sector funds. Have you invested in such funds?